A recent series on Liberty Street Economics took a look at what’s driving a change in the nature of liquidity in key financial markets since the financial crisis. The bloggers examine various measures of liquidity in the Treasury market; consider the implications of technological advances that enable faster trading within and across trading platforms; and address factors, such as regulation, that may be affecting primary dealers’ market-making abilities. See the synopses and links below.

Has U.S. Treasury Market Liquidity Deteriorated? shows that bid-ask spreads for Treasury securities have been narrow and stable since the financial crisis, but finds some evidence of a decline in liquidity in measures such as order book depth and the price impact of trades.

Liquidity during Flash Events considers similarities and differences between episodes of extreme volatility in the U.S. equities, euro-dollar foreign exchange, and U.S. Treasury markets between May 2010 and March 2015.

High-Frequency Cross-Market Activity in U.S. Treasury Markets documents a surge in simultaneous trading between cash and futures platforms and suggests that, from a price discovery perspective, the two markets can be seen as one. The authors find that such trading maintains a stable pricing relationship between related assets, even during periods of extraordinarily high volatility.

The Evolution of Workups in the U.S. Treasury Securities Market observes the continued importance of workup trading as a channel for liquidity in the interdealer cash Treasury market.

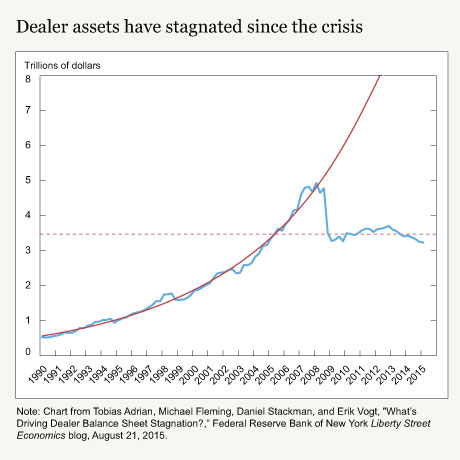

What’s Driving Dealer Balance Sheet Stagnation? investigates whether increased regulation, the housing-crisis aftermath, and electronic trading are factors constraining dealer leverage and risk taking today.