Small Business Finances

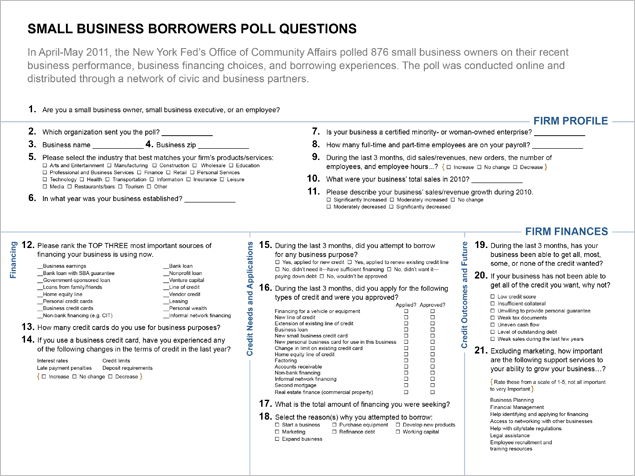

August 2011The New York Feds Small Business Borrowers Poll takes a fresh look at borrower demand by asking firms not only about credit applications but also about reasons for not seeking credit. The results highlight the nuanced assessments that firms are making in formulating credit demands.

The poll finds that although 33 percent of firms sought credit and two-thirds were approved for a credit product, many firms chose not to apply because they were either paying down debt (19 percent), believed they would be turned down (27 percent) or already had sufficient credit (21 percent).

Credit applicants and firms with sufficient credit were similar in having larger revenues and sales increases in 2010 and in the first quarter of 2011. In contrast to these two groups are the 27 percent of the sample who did not apply because they believed they would be turned down. These discouraged borrowers attributed their decisions to concerns about low credit scores and insufficient collateral. A large majority of these firms reported flat or declining sales in the first quarter.

Nineteen percent of the sample did not apply because they were paying down debt. Their responses to questions about sales growth provide clues about why they prioritized deleveraging. Nearly equal portions of this group reported sales increases and sales declines, suggesting that some firms might be responding to broader economic concerns while others may be responding to weakened sales demand at their firms. Deleveraging firms tended to be smaller in revenues and employment.

Poll results also show that most firms rely on business earnings and personal/family wealth, but that credit use varies considerably across groups. Applicants and firms with sufficient financing frequently mentioned using lines of credit. In contrast, both deleveraging firms and discouraged borrowers are relying on credit cards.

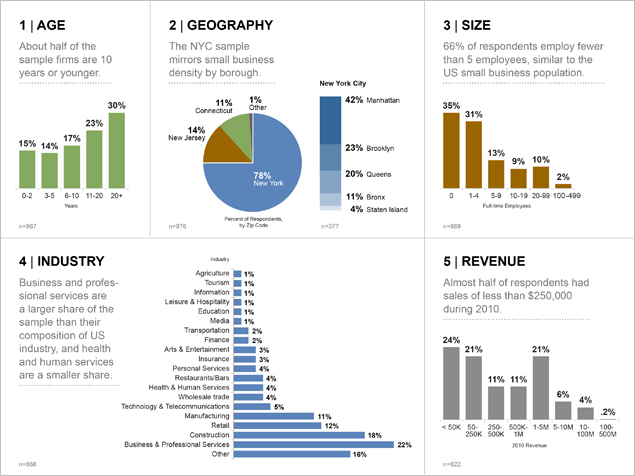

The Small Business Borrowers Poll asks small businesses in the Second District about their business performance and financial and credit experiences. The poll is distributed through a network of civil and nonprofit partners. The poll represents the perspectives of smaller firms (typically fewer than 10 employees and under $5 million in annual revenues) who respond to the questionnaire.

In total, there were 876 poll respondents to the poll fielded in May 2011; however, it is important to note that the number of respondents to each individual question varied. The graphs featured on this page each identify the number of respondents (n=) for relevant questions. If the analysis required cross-tabulation of multiple questions, only firms which responded to all relevant questions were included.

Note: The poll is not a random sample and thus the information should not be interpreted as a statistical representation of small businesses in the Second District or the nation. Rather, the results should be viewed as suggestive and analyzed with awareness of potential methodological biases.

The Federal Reserve Bank of New Yorks Office of Regional and Community Outreach polled small businesses about their business performance, financing choices, and borrowing experiences. The poll was conducted online and distributed through a network of local government and nonprofit partners.

| Arts & Business Council |

| Binghamton Economic Development Office |

| Binghamton Local Development Corporation |

| Brockport Small Business Development Center |

| Broome county Economic Development Zone |

| Broome County Industrial Development Agency |

| Broome County Industrial Development Corporation |

| Business Outreach Center Network |

| Catskill Watershed Corporation |

| Community Capital Resources |

| Connecticut Business and Industry Association |

| Dutchess County Chamber of Commerce |

| Dutchess County Economic Development Corporation |

| Empire State Development |

| Fulton Area Business Alliance |

| Fulton Street BID |

| Hanover Area Chamber of Commerce |

| Hispanic Chamber of Commerce |

| Hudson Valley Economic Development Corporation |

| Kings County Hispanic Chamber of Commerce |

| Long Island City Economic Development Corporation |

| Manhattan Borough President's Office |

| Manhattan Chamber of Commerce |

| Meadowlands Chamber of Commerce |

| Minority Business Development Agency, US Chamber Of Commerce |

| Myrtle Avenue Revitalization Program |

| Newark Regional Business Partnership |

| New Jersey Business and Industry Association |

| New Jersey Chamber of Commerce |

| New York City Council |

| New York City Department of Consumer Affairs |

| New York City Department of Small Business Services |

| New York Public Library |

| Niagara County |

| Niagara USA Chamber |

| NYC Business Solutions |

| Orange County Chamber of Commerce |

| Otsego Chamber of Commerce |

| Procurement Technical Assistance Center |

| Queens Borough President's Office |

| Queens Chamber of Commerce |

| Queens Economic Development Corporation |

| Rochester Business Alliance |

| Small Business Development Centers (NY) |

| Somerset County Business Partnership |

| Sunset Park Business Improvement District |

| Tompkins County Chamber of Commerce |

| Wayne County Business Council |

| Wayne County Economic Development |

| Westchester County Association |

| Williamson Chamber of Commerce |

| Women in Construction |

| Women Presidents' Organization |

|

|

|||

|

2011

|

|||

|

April

|

|||

|

2010

|

|||

|

October

|

|||