Introduction: What Do We Still Need to Know to Evaluate Operational Frameworks?

Thank you for giving me the opportunity to discuss Ulrich Bindseil’s excellent paper, which builds on his considerable body of work in this field and provides an insightful discussion of monetary policy implementation. What makes Ulrich’s contributions notable is the unique combination of academic rigor and practical insights he brings to the topic. By distilling the key elements of his previous research into an accessible form, this article is a useful read for anyone who wants to gain a deeper understanding of the economics of monetary policy implementation, including practitioners of central bank market operations, central bank researchers, and academics. I expect that it will be widely read throughout the Federal Reserve System as we continue our effort to evaluate potential long-run monetary policy implementation frameworks. The remarks that follow are my own personal views and do not necessarily reflect those of the Federal Reserve Bank of New York or the Federal Reserve System.1

As good and comprehensive as Ulrich’s paper is, it cannot cover everything. In my discussion I want to highlight topics on which we need additional insights, in the hope of encouraging further discussion and research that will help us make good decisions regarding monetary policy implementation. Three questions I will discuss are:

- Are some types of money market activity superior to others?

- How should we think of broad-based liquidity provision by central banks given the issue of stigma and taking into account the new liquidity regulations?

- How can we reconcile a desire for a “short” or “lean” balance sheet with asset purchase programs that derive their accommodation from holding assets for a long period of time?

For each of these topics, I will try to bring a U.S. perspective that can hopefully complement Ulrich’s approach. While I commend Ulrich for seeking to identify universal principles, I believe he would agree that some features of monetary policy implementation frameworks can be dependent on country-specific factors, such as legal restrictions or the organization of the financial system.

Money Market Activity

In his paper, Ulrich notes that money markets, and the overnight markets specifically, are very important for the transmission of monetary policy. This is a common perspective among central bankers involved in market operations, which I share as well, although I question whether overnight trading between banks is as special as Ulrich suggests. Money markets are where the policy stance of central banks is most directly expressed in market pricing, either by classic temporary open market operations to vary the quantity of reserves in money markets (as in the Fed’s pre-2008 operating regime) or through the price incentives set by the administered rates available at lending and deposit facilities (as in the ECB’s current full allotment regime).

We have seen a myriad of important changes in money market behavior in recent years, with volume decreasing substantially in some instruments and significant changes in the flows between counterparties. How should we evaluate the current state of our money markets? Are they better, worse, or different but just as good as they were pre-crisis? Unfortunately, I don’t believe we currently have an agreed upon framework to evaluate these changes.

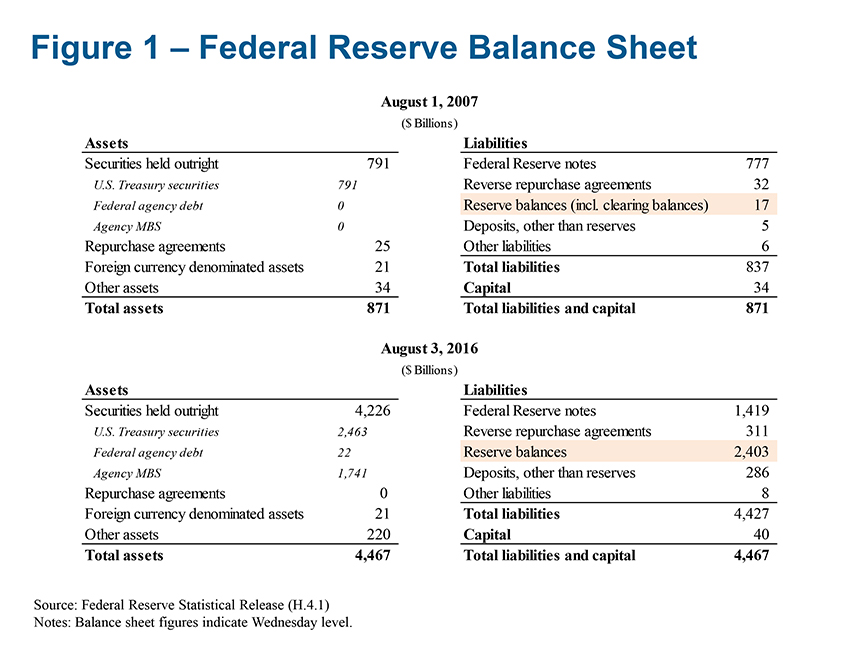

Let me take a concrete example: Prior to the crisis, activity in the overnight interbank federal funds market was driven by the scarcity of reserves balances relative to required and precautionary demand for those reserves by banks.2 This scarcity produced a considerable volume of trading between banks; toward the end of the trading day, banks with more reserves than necessary would have an incentive to trade with banks that had too few reserves.3 After three rounds of large scale asset purchases, aimed at stimulating the real economy, the level of reserves in the United States is about $2.4 trillion today, orders of magnitude larger than the level before the crisis, as can be seen in Figure 1.4 With such a large amount of reserves, very few banks ever need to borrow reserves to meet their requirements, and interbank trading has almost completely disappeared from the fed funds market. Instead, the market is now predominantly composed of trades between government-sponsored enterprises—specifically, Federal Home Loan Banks—and banks.5 In that respect, the fed funds market has come to resemble other segments of the U.S. unsecured money markets, such as the Eurodollar market, where nonbanks lend to banks.6

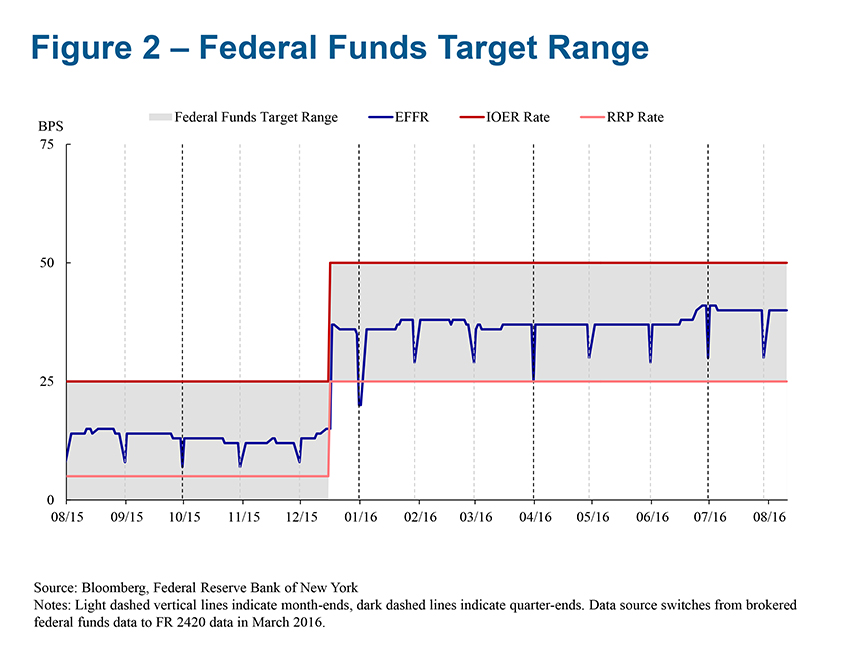

This change in money market activity would clearly have been problematic if it had resulted in a loss of control over the policy rate, but there is no evidence that it has, as can be seen in Figure 2. So, to evaluate the consequences of this change, we are led to ask ourselves questions such as: Is the interbank market special? Ulrich suggests reasons why we might think that it is, but the answer is not clear to me, and further research would be welcome.

Let me elaborate a bit on the differences between these two types of market activity and their implications for rate volatility and market discipline. In the pre-crisis system, a bank’s reserves position evolved, in part, due to payment requests made by its customers, which were somewhat random and thus hard to anticipate. So an important share of interbank market activity was motivated not by fundamentals, but rather the need to fulfill a requirement imposed by the central bank. I always found this type of trading a bit artificial, but perhaps this is just a matter of taste.

In the current U.S. system, the interest rate at which nonbanks lend to banks is determined in large part by the competition among banks. Banks’ borrowings increase the amount of reserves on which they earn interest.

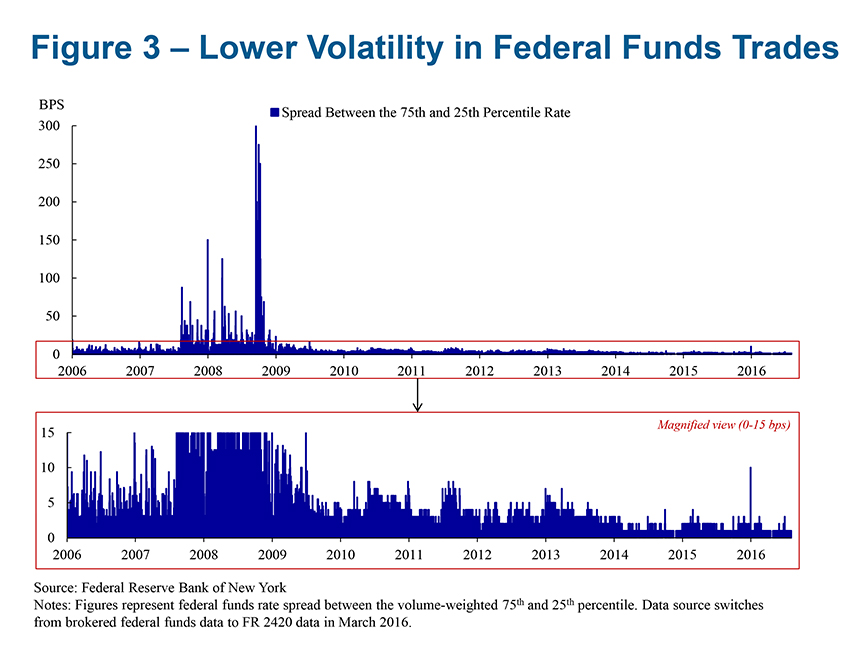

The new environment has delivered outcomes that we have traditionally liked, such as a low volatility of market rates. This should not be surprising; if the same counterparties trade with each other day after day, they don’t have a strong incentive to renegotiate the interest rate at which they trade every day, relative to the policy rate. In contrast, if banks trade with each other infrequently, because one happens to have too many reserves on a given day and the other happens to have too few, they will have to negotiate a rate for that trade. A number of idiosyncratic factors could influence the terms of that trade, such as how desperate the borrower is at the end of the day, which could add unnecessary noise to market rates. Figure 3 illustrates this change.7

Turning to market discipline, Ulrich notes that the interbank market may perform this function particularly well because it is a peer-to-peer market. I would like to see more empirical research before I can feel comfortable that money markets provide much market discipline, especially in overnight markets. If the monitoring was so good pre-crisis, why did we have a crisis? One reason to question how much money market participants monitor the counterparties to which they lend is that it is hard to appropriate the value from such monitoring. Money market “freezes” may affect financial institutions somewhat indiscriminately, and, for that reason, lenders may prefer to withdraw short-term funding indiscriminately when they fear other lenders might do so.

If money market participants provide some market discipline, we could expect nonbank lenders in U.S. money markets to do this effectively. They are sophisticated financial institutions that have established relationships with the banks to which they lend. And, because they lend to these banks on a consistent basis, they have strong incentives to monitor their counterparties.8

While my assessment is necessarily preliminary, I don’t see a reason why one type of money market activity should be preferred over another. Recent experience does not suggest that the interbank market is special or that keeping an abundance of excess reserves prevents effective monetary policy implementation.

Further, we should be mindful of the fact that banks may not be as eager to trade as much with each other in the new regulatory environment because they now face costs of expanding their balance sheet. In the U.S., the leverage ratio has been increased and the Federal Deposit Insurance Corporation has modified the base for the insurance fee it assesses on banks, effectively making it a function of the bank’s liabilities or the size of its balance sheet in excess of capital.9

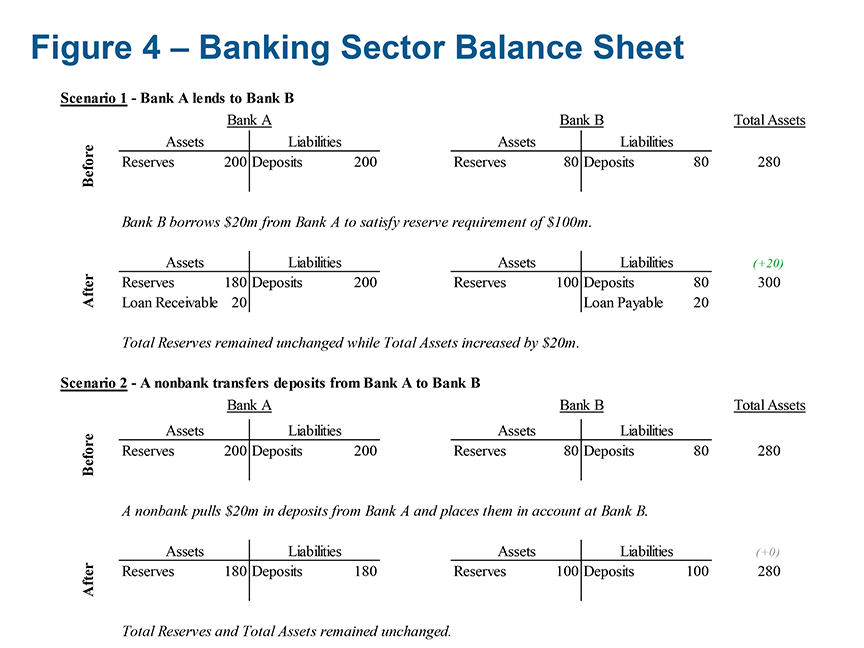

To understand why interbank trades are costly in this environment, consider the following example. Suppose Bank A has too many reserves and Bank B too few. One way to transfer reserves from Bank A to Bank B is through an interbank loan. The size of the balance sheet of Bank A would not change as a result of such a loan because the reduction in reserves would be offset by the loan to Bank B. The balance sheet of Bank B would increase in size by the amount of reserves it receives, as shown in upper part of Figure 4. What this example illustrates is that interbank trade increases the aggregate size of the balance sheet of the banking sector.

Suppose, instead, that a nonbank that is currently lending to Bank A would lend to Bank B. As a result Bank A would have fewer reserves and deposits, so its balance sheet would decrease in size. Bank B would have additional reserves and its balance sheet would increase in size, just as in the above example. However the size of the aggregate balance sheet of the banking sector would not change, as shown in the lower part of Figure 4. The two sets of transactions achieve the same movement of reserves from Bank A to Bank B, but if there is a cost associated with the size of banks’ balance sheets, then the second option would likely be preferred. The three parties would be expected to find a way to share the surplus generated by the lower balance sheet cost.10

The balance sheet cost associated with the interbank trade can be thought of as capturing the additional risk introduced into the system by that trade. One side effect of interbank trades is that they create a network of exposures that can contribute to financial fragility, as we saw during the crisis.

Central Bank Liquidity Provision

Let me now turn to the question of broad-based liquidity provision by central banks. As Ulrich notes, there is an academic literature on the topic that focuses primarily on the incentives that individual financial institutions may have to take on excessive risk if they expect the central bank to provide insurance ex post; an incentive often referred to as moral hazard. This framing had become so pervasive that central bankers relied on constructive ambiguity—the idea that if market participants were unsure about whether the central bank might supply liquidity, they might not be as tempted to take privately beneficial but socially costly actions. I don’t intend to discuss constructive ambiguity, but I find it striking that there is little research on this topic directly related to central banking that could help us think of the costs and benefits of such an approach.11 More generally, now might be a good time for academics and central bank researchers to take a fresh look at the issues of central bank liquidity provision, taking into account, in particular, stigma and liquidity regulation.12

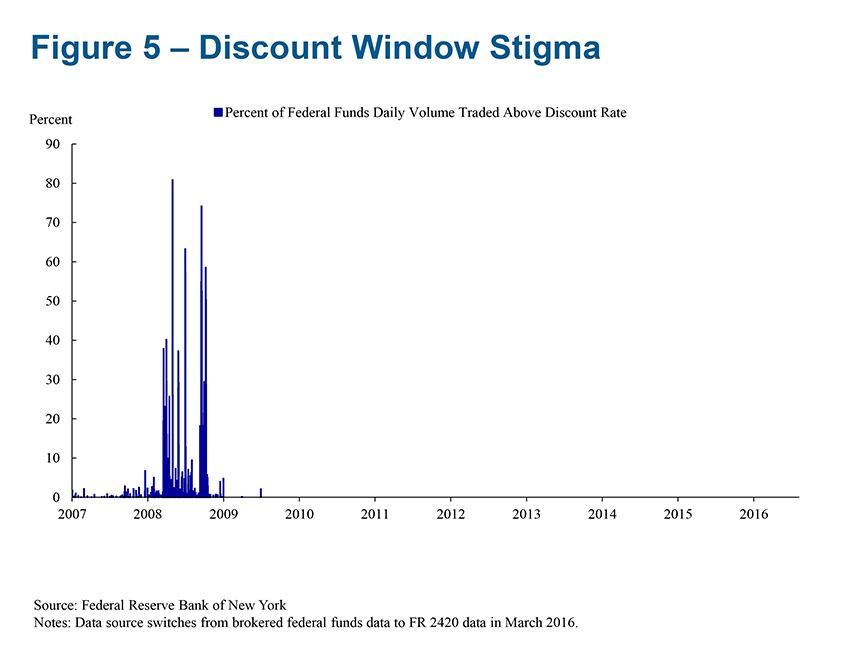

Let me start with stigma. In some countries, like the U.S. and the U.K., stigma appeared to be sufficiently strong that banks did not use the central bank’s liquidity facilities at their disposal as much as would have been socially desirable.13 During the crisis, the Federal Reserve encouraged banks to borrow at its discount window, to little effect.14 As can be seen in Figure 5, much activity in the fed funds market took place at rates above the discount rate. This led to the creation of the Term Auction Facility, or TAF, which used an auction mechanism to allocate funds in the hope that banks would feel more comfortable borrowing if other banks were doing the same. The TAF was a success and can perhaps teach us something about ways to mitigate stigma. The ECB seems to have had a different experience. Its lending facilities do not appear to have suffered from stigma to the same extent as those in the U.S. or the U.K.15 This is related to the fact that banks rely more consistently on central bank provided liquidity in the euro area. This difference could perhaps provide insights into what gives rise to stigma and how to address it. In any case, understanding stigma, and potential ways to mitigate it, seems like an under-researched area at the moment.16

Let me put aside stigma now and focus on moral hazard. An important development, which researchers should take into account when thinking about liquidity provision and moral hazard, is new liquidity regulation.17 Ulrich is not an optimist when it comes to the ability of regulations to mitigate moral hazard. As exhibited in Figure 6, he notes that

“…managing liquidity risk is a core activity of banking, and it seems unlikely that centralizing this subtle activity through liquidity regulation can be done without efficiency costs. Therefore liquidity regulation must not be overburdened, and central banks providing some well-designed and rule based economic counterincentives to an excessive reliance on the [lender of last resort] is an important contribution to reduce the burden put on regulation.”

I agree with Ulrich there, and would emphasize that banks’ core functions can be strengthened through the aims and standards set by regulation.18 But the task is not just calibrating the combination of well-designed regulation and appropriate incentives for taking recourse to the lender of last resort. Ulrich seems to ignore the importance of prudential supervision and its potential contribution to mitigating moral hazard.19 Regulation involves the development and promulgation of the rules under which banks and other regulated financial intermediaries operate. Prudential supervision involves the monitoring and oversight of regulated institutions to assess whether they are in compliance with law and regulation and whether they are engaged in unsafe or unsound practices, and it ensures that firms are taking corrective actions to address any such practices.20 Regulation cannot be subtle, although its implementation, through supervision, likely can be. And let’s not forget that the tools available to prevent moral hazard generated by central bank liquidity facilities, such as penalty pricing, are rather blunt tools themselves.

Don’t get me wrong, I don’t mean to suggest that moral hazard is not something we should worry about when thinking about the liquidity provision tools that are integrated in our monetary policy implementation frameworks. We should carefully consider the incentives any of our tools create. Instead, the message I would like to convey is that there may be benefits to specialization among complementary functions of the central bank. Making sure that banks don’t take excessive liquidity risk is a core role of supervision, and supervisors are likely to be much better at this task than the staff of market operations departments. Providing liquidity to financial markets in real time, to make sure money markets remain connected, that the stance of monetary policy is appropriately transmitted to the real economy, and to support financial stability, is a core role of market operations departments. A long history of financial crises has shown that central banks can add liquidity to the system when it is most needed, especially at time when private institutions are unable to do so.

Balance Sheet Normalization

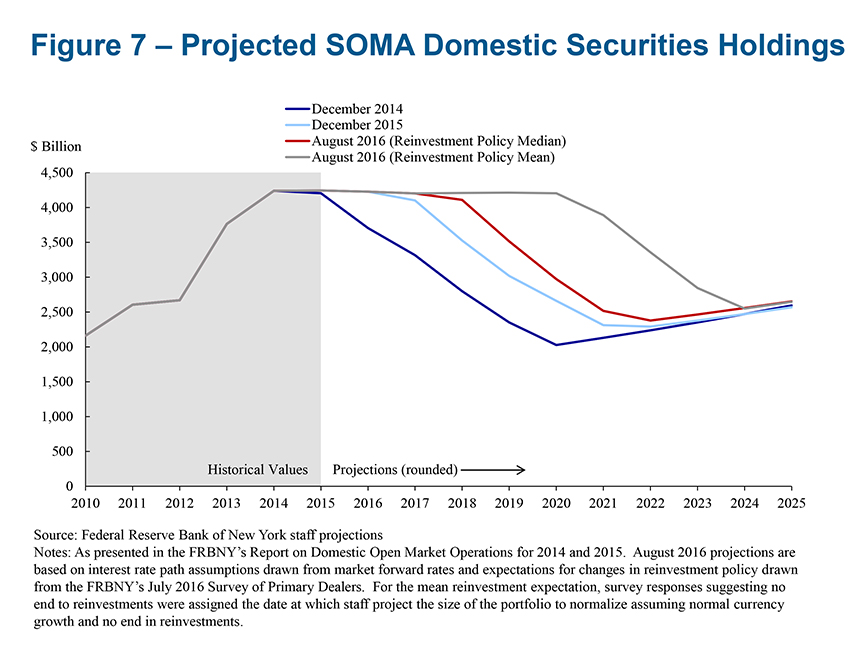

My discussion so far has focused on the longer-run. However, the current situation also needs to be taken into account: Today, many advanced economy central banks find themselves in a situation where their policy rate is at or close to zero, and policy accommodation is being added or maintained by asset purchases and forward guidance. For example, the FOMC has indicated that it will continue reinvestment of principal payments on its portfolio until normalization of the fed funds rate is well underway. As can be seen in Figure 7, market estimates of when the SOMA portfolio will start to normalize have moved out from the end 2015 to the middle of 2018 or even later.

Ulrich expresses a strong preference for a balance sheet which is short or lean, i.e. closer in size to the amount of currency outstanding.21 The argument for such a lean balance sheet in normal times is strong and is encapsulated in the Federal Reserve’s 2014 Policy Normalization Principles and Plans. That said, if asset purchases work through stock effects and, thus, require a long holding period, how exactly do we get to a lean balance sheet or, as we call it, balance sheet normalization?22

One possibility is that the time between visits to the zero bound will be sufficiently long relative to the duration of assets added to the balance sheet that, in practice, this will not be a problem. I am sure everyone in the audience would be happy if this were the reality; I certainly would be. Another possibility is that balance sheet normalization could be accelerated by asset sales. However, we only have experience with selling shorter-duration assets; sales of longer-duration assets, which carry some uncertainty, would be necessary to speed the path to a leaner balance sheet. 23

The more worrying possibility is that the duration of time spent away from the zero bound will be considerably shorter than the average remaining duration of assets on the central banks’ balance sheet after moving away from the zero bound. Such a scenario seems to make the objective of a lean balance sheet difficult to achieve and raises a number of important questions we should think about carefully. For example, is there a size of the central bank’s balance sheet beyond which further asset purchases become difficult or perhaps less effective? What are the fiscal implications of large central bank balance sheets?24 More research on these topics seems highly desirable.

Conclusion

To conclude, I want to congratulate Ulrich for an excellent paper that should be required reading in central banks that are thinking about their monetary policy implementation frameworks. Ulrich provides a unique blend of academic and practitioner insight from which I learned a lot. I do believe that there remain some important unanswered questions when it comes to evaluating monetary policy implementation frameworks. Ulrich’s paper starts us on the right path and hopefully the broader research community can start to work on some of these important issues.

1 My thoughts on implementation issues have been enriched by numerous conversations with colleagues, particularly around the current longer-run efforts in the Federal Reserve to examine implementation. Recent dialogue with Antoine Martin was particularly helpful in producing this discussion.

2 A byproduct of the scarcity of reserves is that central banks had to lend a considerable amount of intraday credit to facilitate the settling of payments. In the U.S., the average of the daily peak level of daylight overdrafts provided by the Federal Reserve was roughly $140 billion in 2006.

3 In the U.S., only depository institutions (banks) and a small number of other institutions, such as government-sponsored enterprises, which include the Federal Home Loan Banks, can have an account with the Federal Reserve. Depository institutions are subject to reserve requirements.

4 In 2006, total balance requirements averaged approximately $15 billion, composed of required reserve balances (the portion of reserve requirements not met with vault cash) and contractual clearing balances. The amount of reserves held in excess of requirements was about $1.7 billion on average. Banks also used around $35 billion in vault cash to satisfy reserve requirements; however, since vault cash cannot be used to clear Fedwire payments, it has no intraday impact on federal funds trading activity.

5 During the first half of 2016, less than 5 percent of fed funds transactions were interbank transactions, based on the FR2420 data, or about $3 billion per day on average.

6 Nonbank financial institutions, such as mutual funds, money market mutual funds, and asset managers, among others, play an important role as lenders in U.S. money markets. The role played by these institutions in the euro area is considerably smaller.

7 In theory, the discount window should reduce some of this volatility. In practice, stigma has prevented it from playing that role effectively, as I will discuss further.

8 Nonbank lenders’ use of counterparty credit limits suggests such monitoring indeed occurs. Even so, nonbank lenders may be captive to perceptions of their investors (who may be less informed and more skittish), resulting in preemptive reductions in exposures to some bank counterparties and contributing to market freezes in spite of lenders’ own analysis.

9 The leverage ratio creates a direct cost only if it is binding but banks also appear to take into account the possibility of it binding in the future and how it might be treated in stress tests.

10 Another way to reduce the balance sheet cost faced by the banking sector is to allow nonbanks to hold some of the central bank’s liabilities directly. For example, every dollar invested in the Federal Reserve’s overnight reverse repo facility decreases the amount of reserves held by banks and, thus, the aggregate size of the banking system’s balance sheet by a dollar.

11Keister (2016) shows that it is optimal to commit to providing liquidity to a bank that faces a run. Moral hazard is addressed ex ante, by setting a Pigouvian tax that gives incentives for the bank to invest in the optimal amount of liquid assets. The tax can be interpreted as liquidity regulation and supervision. Goodfriend and Lacker (1999), however, argue that neither constructive ambiguity nor extended supervisory and regulatory reach can effectively overcome the fundamental forces that cause a central bank to lend. They propose that the only way for a central bank to credibly limit lending is for it to build a reputation over time for restraining lending.

12 Carlson, Duygan-Bump, and Nelson (2015) argue that central bank liquidity provision and liquidity regulations are complementary tools.

13 The Bank of England (2013) defines stigma as “the risk that drawings from [the central bank’s liquidity] facilities may be taken as a signal (by investors, depositors, rating agencies, regulators or even firms’ own boards of directors) of more serious weaknesses at the firm in question.

14 See for example Federal Reserve (2007).

15 This is a feature of the ECB’s operating framework, which relies on a broad counterparty set and broad collateral base for its routine policy implementation operations.

16 The Bank of England (2013) describes some concrete steps it has taken to mitigate potential stigma.

17 In addition to the liquidity regulation introduced by Basel III, the SEC’s money market mutual fund reform should reduce imprudent risk-taking funded by the money fund industry.

18 Like liquidity risk management, credit risk management is also a core function of banks. However, I suspect few would suggest capital regulation is unnecessary.

19 In 2012, the Federal Reserve launched the Comprehensive Liquidity Assessment and Review (CLAR) for firms in the Large Institution Supervision Coordinating Committee (LISCC) portfolio. Like the Comprehensive Capital Analysis and Review, CLAR is an annual horizontal assessment, with quantitative and qualitative elements, overseen by a multidisciplinary committee of liquidity experts from across the Federal Reserve. In CLAR, supervisors assess the adequacy of LISCC portfolio firms' liquidity positions relative to their unique risks and test the reliability of these firms' approaches to managing liquidity risk. CLAR provides a regular opportunity for supervisors to respond to evolving liquidity risks and firm practices over time. See Tarullo (2014) for more detail.

20 See Eisenbach et al. (2015).

21 Ulrich also spends considerable time discussing market neutrality and its implications for the assets central banks should hold against currency. As he notes, there is a large difference in approach between the Federal Reserve and the Bundesbank in this regard.

22 A central bank that does not hold the assets it has purchased as long as market participants anticipate could lose credibility, making future asset purchases less effective.

23 In 2006, the Bank of Japan ended its Quantitative Easing Policy and returned to a lean balance sheet within a few months. This speedy return was facilitated by the short duration of the assets on their balance sheet. Of course, their motivation for such a speedy return was to reduce reserves quickly to regain control of overnight rates. This motivation no longer seems necessary, at least in the U.S., given the Fed’s successful liftoff.

24 See Tucker (2016) for a consideration of these issues.

References

Bank of England (2013). “Liquidity Insurance at the Bank of England: Developments in the Sterling Monetary Framework.”

Carlson, Mark, Burcu Duygan-Bump, and William Nelson (2015). “Why Do We Need Both Liquidity Regulations and a Lender of Last Resort? A Perspective from Federal Reserve Lending during the 2007-09 U.S. Financial Crisis.” Finance and Economics Discussion Series 2015-011. Washington: Board of Governors of the Federal Reserve System.

Eisenbach, Thomas, Andrew Haughwout, Beverly Hirtle, Anna Kovner, David Lucca, and Matthew Plosser (2015). “Supervising Large, Complex Financial Institutions: What Do Supervisors Do?,” Federal Reserve Bank of New York Staff Reports, no. 729, May.

Federal Reserve (2007). Press Release August 17, 2007.

Goodfriend, Marvin and Jeffrey M. Lacker (1999).“Limited Commitment and Central Bank Lending.” Federal Reserve Bank of Richmond Economic Quarterly,Volume 85/4, Fall.

Keister, Todd (2016). “Bailouts and Financial Fragility.” Review of Economic Studies, Vol. 83: 704–736.

Tarullo, Daniel K. (2014). “Liquidity Regulation.” November 20, 2014, speech at the Clearing House 2014 Annual Conference, New York.

Tucker, Paul, (2016). “The Political Economy of Central Bank Balance Sheet Management.” May 5, 2016, prepared for a workshop jointly sponsored by Columbia University’s School of International and Public Affairs and the Federal Reserve Bank of New York, New York.