Good afternoon, and thank you, Governor Yaron, for that kind introduction. It’s truly a pleasure to speak at this conference.

So much has happened in the world and in monetary policy in the year and a half since the onset of the COVID-19 pandemic. However, I will not use my time today to discuss the specific challenges posed by the pandemic. Rather, I will return to a topic that predates COVID-19 and will be critically important for central banks in the post-pandemic era: How inflation targeting should evolve to be successful in the context of a global economy characterized by very low neutral interest rates.

I will start by describing the challenges that the combination of the very low level of real neutral interest rates and the lower bound on nominal interest rates pose for standard versions of inflation targeting. I will then summarize the theoretical underpinnings of what is commonly referred to as Average Inflation Targeting, or AIT for short. I will focus on the key characteristics of various versions of AIT and how they can help mitigate the deleterious effects of the lower bound on interest rates on macroeconomic outcomes. I should be clear from the start that the goal of my presentation is to engage in the broad academic and central bank discussion on monetary policy strategies, and that this is not, and should not be interpreted as, a description of the Federal Reserve’s new policy framework or the practical application of AIT to real-world situations. I would also be remiss not to mention that most of what I discuss today is based on research conducted with my esteemed colleague Thomas Mertens at the Federal Reserve Bank of San Francisco.

With that preamble, it is time to give the standard Fed disclaimer that the views I express are my own and do not necessarily reflect those of the Federal Open Market Committee or anyone else in the Federal Reserve System.

What Is Past Is Prologue: The Decline in R-star

The adoption of inflation targeting by many central banks succeeded in bringing the high and variable inflation rates of the 1970s and 1980s under control and anchoring inflation expectations. The success in attaining price stability and well-anchored inflation expectations was a monumental achievement in central banking and one that is critically important to sustain.

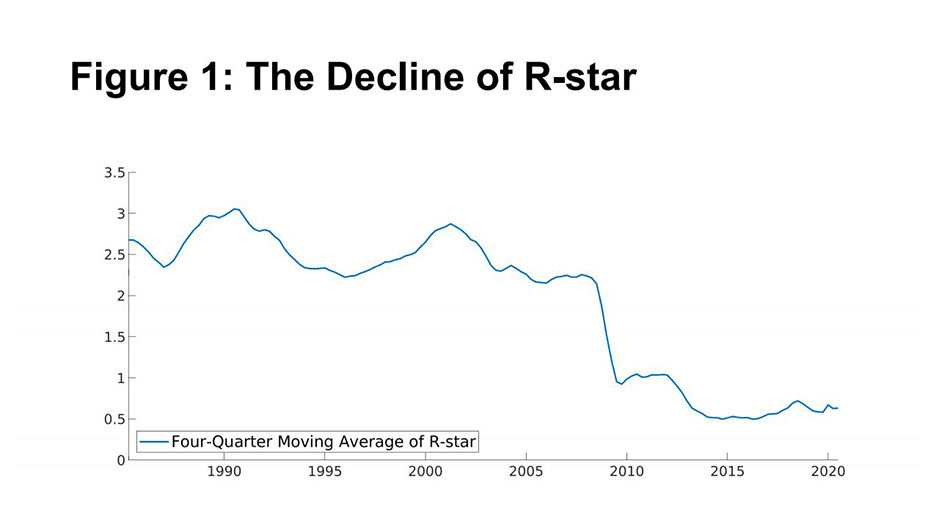

However, the significant decline in the neutral rate of interest observed across the globe poses a fundamental challenge to the ability of inflation-targeting central banks to achieve desired macroeconomic objectives and anchor inflation expectations at the targeted level. Figure 1 shows the GDP-weighted average of the Holston, Laubach, and Williams (2017) estimates of the longer-term real neutral interest rates, or r-star, for Canada, the euro area, the United Kingdom, and the United States through the second quarter of 2020. As seen in the figure, and consistent with a variety of other analyses, there has been a dramatic decline in r-star over the past quarter century. Several global developments have driven this decline—including demographic shifts, lower productivity growth, and increased demand for safe assets—and these trends do not appear likely to reverse anytime soon.1

Due in part to the decline in neutral interest rates, central banks have been increasingly constrained by the lower bound on nominal interest rates, including after the outbreak of COVID-19. The lower bound on interest rates has hindered their ability to use lower short-term interest rates to offset negative shocks, contributing to inflation rates averaging below targeted levels in many countries.

A Simple Model of Monetary Policy with a Lower Bound on Interest Rates

To highlight the connections between r-star, the lower bound on interest rates, and below-target inflation, Thomas Mertens and I analyze a simple New Keynesian model where the lower bound occasionally constrains the ability of the central bank to offset negative shocks to the economy.2 Our analysis shows that due to the presence of the lower bound on interest rates, standard inflation targeting under discretion leads to inflation that is, on average, below the target level. This below-target average inflation, in turn, causes expected inflation to be below the target level, to the detriment of the achievement of macroeconomic goals.

To keep the analysis tractable, the inflation-targeting central bank is assumed to follow optimal policy under discretion using the short-term interest rate as its sole policy instrument; that is, we ignore other policy tools like asset purchases that can provide additional monetary stimulus following negative shocks and thereby reduce the severity of the effects of the lower bound on the economy.3 Absent the lower bound on interest rates, optimal policy would fully offset demand shocks and partially offset supply shocks. This results in inflation and inflation expectations that are at the target level on average.

This happy set of circumstances is upset by the lower bound on interest rates occasionally constraining the ability of policy to respond to negative shocks to the economy. Owing to the inherent asymmetry of the lower bound, monetary policy responds more strongly on average to positive shocks than to negative ones. From there, it’s a simple matter of arithmetic: shortfalls of inflation from targeted levels will on average be larger than overshoots, and, as a consequence, the average inflation rate will be below targeted levels.4 With inflation averaging below the target level, inflation expectations will also be anchored below target. The reduction in inflation expectations, in turn, exacerbates the effects of the lower bound on the economy. These results hold whether the central bank targets only the inflation rate or has dual objectives related to inflation and output.

In our current research, Thomas Mertens and I have extended this analysis to a two-country model and examined the spillovers from the lower bound across borders. The basic conclusion from this work is that the presence of the lower bound adds to the ways by which economic conditions spill over across economies that can exacerbate the deleterious effects of the lower bound in each country. The implication is that the greater the effects of the lower bound are on the economy of a trading partner, the greater the challenge for the domestic central bank in achieving its macroeconomic goals.

Average Inflation Targeting

A number of modifications to standard inflation targeting have been proposed to address the effects of the lower bound on interest rates.5 Although each proposal has unique features and implications, many can be broadly described under the big tent of “Average Inflation Targeting” in that they aim to “overshoot” the long-run inflation target at times so that the inflation rate is close, or equal, to the targeted level on average.6

One relatively modest modification to standard textbook inflation targeting is what we call Static Average Inflation Targeting, or SAIT. The SAIT policy is identical to standard inflation targeting except that it overcomes the downward bias to average inflation caused by the lower bound by overshooting the inflation target in periods when the lower bound does not constrain policy.7 This is equivalent to reducing the intercept in the monetary policy rule by an appropriate amount, which depends on the probability of being at the lower bound and other parameters.8

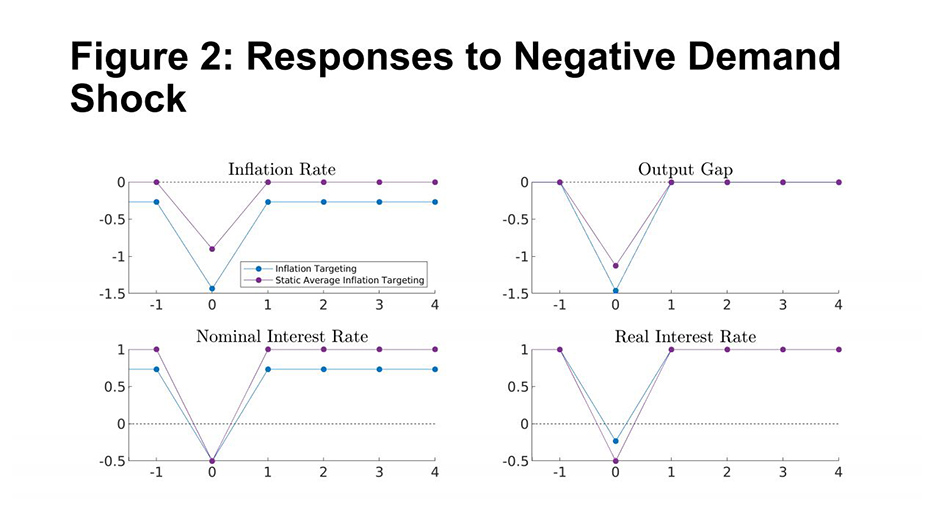

Figure 2 shows the model responses of inflation, the output gap, and nominal and real interest rates to a severe negative demand shock that lasts for one period (labeled period 0 in the figure), under standard inflation targeting and SAIT. Note that for these simulations, I assume the following: the long-run target level of the inflation rate is zero, the lower bound is -0.5 percent, and the real neutral rate is 1 percent.9

Under standard inflation targeting, inflation is on average below the target, as seen clearly in the levels of inflation in periods before and after the shock. In response to the negative demand shock, the lower bound constrains the inflation targeting policy, and the output gap and inflation fall further below targeted levels before returning to their corresponding mean levels in the following period.

In contrast, the SAIT policy delivers inflation and inflation expectations that are on average equal to the targeted level. This higher level of expected inflation boosts inflation in the period of the negative shock and creates more room for policy to lower the real interest rate below the neutral rate. As a result, the shortfalls in the output gap and inflation are attenuated relative to standard inflation targeting. Note that the effectiveness of SAIT is based solely on anchoring inflation expectations at the target, which is achieved by delivering a longer-term mean inflation rate equal to the target.

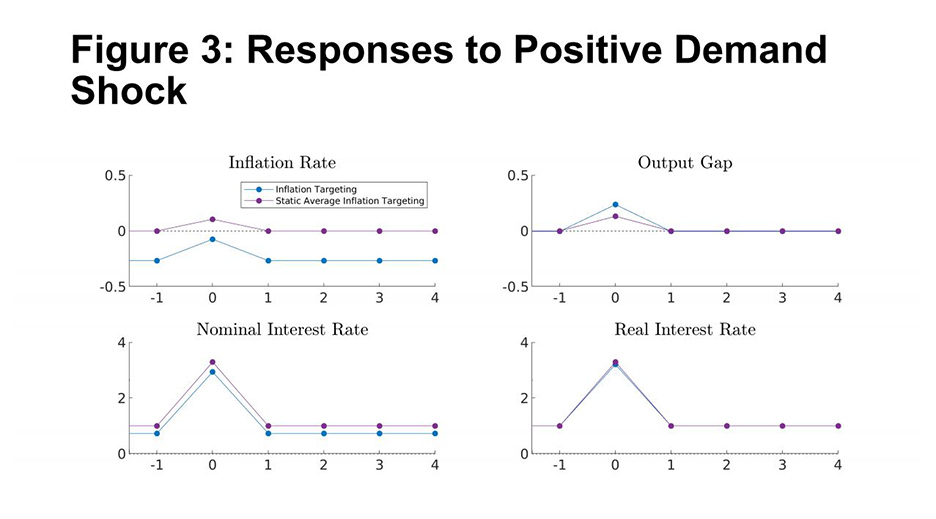

To better see how the SAIT policy works, it’s also useful to look at the responses to a positive demand shock, shown in Figure 3. Under both standard inflation targeting and SAIT, the demand shock is fully offset by a higher real interest rate. However, that does not imply that the output gap equals zero. Under inflation targeting, the fact that inflation expectations are below target causes policy to be slightly accommodative, leading to a positive output gap and inflation that is closer to—but still below—target. Under SAIT, policy intentionally aims for a positive output gap and inflation rate. This is the overshooting feature of SAIT that provides the positive offset to outcomes when policy is constrained, thereby bringing mean inflation and the output gap equal to their respective long-run target levels. Note that these outcomes under both inflation targeting and SAIT are invariant to the size of the demand shock as long as policy is unconstrained by the lower bound.

A number of alternatives to AIT have been proposed that include dependence on the past state of the economy—either in terms of interest rates or inflation—and we refer to these as “dynamic average inflation targeting,” or DAIT. These include policies that target a multiyear average of inflation, target the price level, or account for past constraints on the setting of monetary policy. Although they differ in their details, these proposed policies fundamentally work through the same mechanism of delivering interest rates that are “lower for longer” following a negative shock. Under these policies, expectations of easier monetary policy in the future provide additional policy stimulus while the lower bound constraint is binding, thus ameliorating the negative effects of the lower bound constraint on the economy.

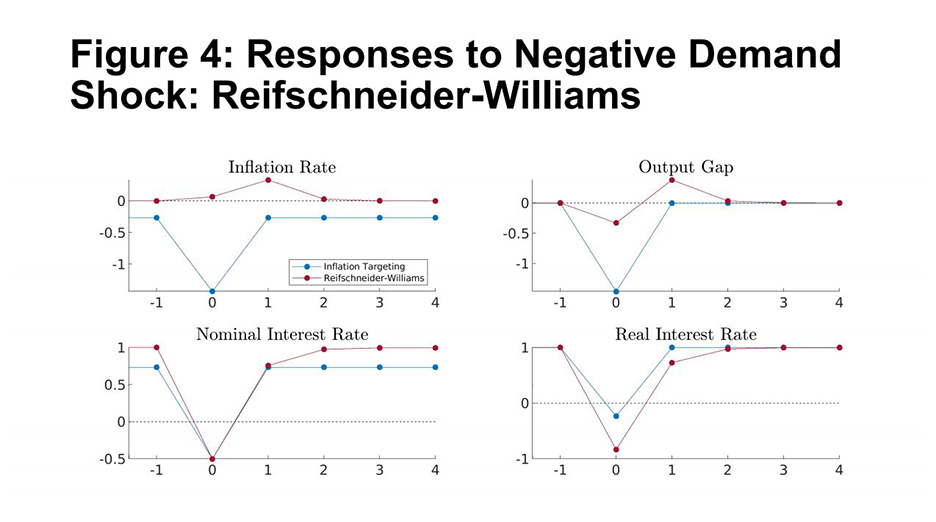

To keep things simple, I will focus on just one version of DAIT—that is, the proposed policy rule that Dave Reifschneider and I included in our paper from over 20 years ago.10 This policy rule is otherwise identical to inflation targeting, but makes up for past missed monetary stimulus owing to the lower bound constraint. Specifically, the current setting of policy is adjusted based on a term that keeps track of the cumulative past effects of the lower bound on the setting of interest rates, net of past “make-up” adjustments to policy. The behavior of the Reifschneider-Williams (RW) policy rule following episodes of policy being constrained by the lower bound is qualitatively very similar to those of policies that target a multi-period average rate of inflation and price-level targeting.11

The RW rule delivers inflation and inflation expectations that are on average equal to the targeted level, as the “lower-for-longer” setting of interest rates following periods where the lower bound constrains policy mitigates the effects of negative shocks on the economy. Figure 4 compares the responses to a negative demand shock under the RW rule to that under standard inflation targeting. Under the RW policy, the real interest rate is below the neutral real interest rate in the period following the shock, reflecting the effect of the make-up for missed monetary stimulus during the period of the shock. As a result, the output gap and inflation rate are above target levels in the period following the shock, and then return close to target levels in the subsequent period.12 This is the key feature of DAIT policies: the expectation of future stimulus supports the economy during the time when policy is constrained by the lower bound. Of course, for this to work in practice, expectations of future policy actions and their economic consequences must be aligned with the policy strategy.

So far, I have aimed to provide the high-level theoretical underpinnings of AIT policies and their potential advantages in an environment where the lower bound occasionally constrains monetary policy. Commentators have highlighted a number of potential shortcomings of AIT relative to standard inflation targeting. I will briefly address two in the time remaining.

The first claim is that the overshooting of the inflation target implied by AIT risks undermining the anchoring of inflation expectations to the upside. I would argue that, if anything, AIT strengthens the expectations anchor compared to standard inflation targeting. The main point of AIT is to offset the downward bias to inflation expectations exerted by the lower bound under inflation targeting. That said, if the lower bound were to prove to be a less frequent constraint on policy in the future, then the AIT policies that I have described would act very much like standard inflation targeting.

The second claim is that AIT implies sharp reversals of interest rates as monetary policy exits a “lower for longer” episode and may find itself “behind the curve.” However, as seen in the responses of nominal and real interest rates to the shocks shown in Figures 2-4, there is no predictable pattern of sharp reversals or large overshooting of policy rates relative to neutral, either for static or dynamic AIT policies.13 It is true that nominal and real interest rates have more room to fall under AIT policies in response to negative shocks compared to inflation targeting, and therefore the rebound to the neutral rate is correspondingly larger. But, that larger rebound is a feature of the success of the policy. In addition, the RW policy is still below neutral when the output gap and inflation are above target, so the reversal of rates is actually gradual, not rapid.

Of course, the policy setting depends on the sequence of shocks and the particular model used for the analysis. Although the results I have reported are derived from a very simple model, the main findings about the benefits of AIT also are obtained in much more complex models with extensive nominal rigidities, as shown in Reifschneider and Williams (2000).

Conclusion

To close, in this presentation I aimed to provide a high-level theoretical overview of the mechanisms by which versions of average inflation targeting can deliver improved macroeconomic outcomes in the presence of a lower bound on interest rates.

Importantly, the versions of AIT that I described represent an evolution of inflation targeting, rather than a revolution. Indeed, the aims are the same: to ensure well-anchored inflation and inflation expectations at the target level.

Thank you. I look forward to your questions.

References

Amano, Robert, Stefano Gnocchi, Sylvain Leduc, Joel Wagner. 2020. “Average Is Good Enough: Average-Inflation Targeting and the ELB.” Federal Reserve Bank of San Francisco Working Paper (June).

Bernanke, Ben S. 2017. “Monetary Policy in a New Era.” Paper presented at Rethinking Macroeconomic Policy conference, Peterson Institute for International Economics, October 12-13.

Bernanke, Ben S., Michael T. Kiley, and John M. Roberts. 2019. “Monetary Policy Strategies for a Low-Rate Environment.” AEA Papers and Proceedings 109 (May): 421-26.

Evans, Charles L. 2010. “Monetary Policy in a Low-Inflation Environment: Developing a State-Contingent Price-Level Target.” Speech at the Federal Reserve Bank of Boston’s 55th Economic Conference, Revisiting Monetary Policy in a Low Inflation Environment, Boston, October 16.

Holston, Kathryn, Thomas Laubach, and John C. Williams. 2017. “Measuring the Natural Rate of Interest: International Trends and Determinants.” Journal of International Economics, 108 (May): S59-S75.

Laubach, Thomas, and John C. Williams. 2016. “Measuring the Natural Rate of Interest Redux.” Business Economics, 51 (April): 57-67.

Mertens, Thomas M., and John C. Williams. 2019. “Monetary Policy Frameworks and the Effective Lower Bound on Interest Rates.” AEA Papers and Proceedings, 109 (May): 427-32.

Mertens, Thomas M., and John C. Williams. 2020. “Tying Down the Anchor: Monetary Policy Rules and the Lower Bound on Interest Rates.” In Strategies for Monetary Policy, edited by John H. Cochrane and John B. Taylor, 103-54. Stanford, CA: Hoover Institution Press.

Mertens, Thomas M., and John C. Williams. Forthcoming. “What to Expect from the Lower Bound on Interest Rates: Evidence from Derivatives Prices.” American Economic Review. (Federal Reserve Bank of San Francisco Working Paper 2018-03, 2018, revised September 2020.)

Reifschneider, David, and John C. Williams. 2000. “Three Lessons for Monetary Policy in a Low Inflation Era.” Journal of Money, Credit, and Banking, 32(4) (November): 936-66.

Svensson, Lars E.O. 2020. “Monetary Policy Strategies for the Federal Reserve.” International Journal of Central Banking 16 (February) 133-93.

Williams, John C. 2018. “The Future Fortunes of R-star: Are They Really Rising?” Federal Reserve Bank of San Francisco Economic Letter, 2018-13 (May 21).