Under any circumstances it is an honor to present the Mundell-Fleming Lecture of the IMF Annual Research Conference. Thank you Kristalina Georgieva (Managing Director, IMF) and Gita Gopinath (First Deputy Managing Director, IMF) for this honor. Thank you Pierre-Olivier Gourinchas (Economic Counsellor and Director, Research Department, IMF) for your generous words of introduction. You are united in your commitment to a well-functioning international monetary system, to strong economies around the world, and to addressing those vulnerabilities that limit the ability of countries to obtain their best outcomes.

I speak today on my own behalf, and the views expressed do not necessarily reflect those of the Federal Reserve Bank of New York or the Federal Reserve System.

It is a special privilege to be at this 23rd Jacques Polak Conference, as during these two days we honor Maurice Obstfeld, an economist for whom we all have tremendous respect. Maury has made so many deeply insightful contributions to our understanding of international monetary history and international finance.

Some foundational contributions are in modelling inter-temporal considerations — for example with his work with Ken Rogoff on New Open Economy Models, which served as the starting point for Pierre-Olivier Gourinchas's Mundell-Fleming Lecture last year (Gourinchas 2021). Pierre-Olivier showed how theory is increasingly able to incorporate economic and financial granularity: networks, frictions, heterogeneity. I will discuss this granularity, but from an empirical perspective.

I am personally inspired by Maury's scholarship and intellectual integrity, and his deep thinking about big picture questions of the entire international monetary system. Likewise, by Maury's capacity to position his observations into the broader contributions of diverse thought-leaders, taking sweeping views of the history of thought on these topics. In developing my own comments for this lecture today, I follow Maury's lead a bit. I will tie some of my key points to some history of thought showcased here at the IMF in past Mundell-Fleming Lectures.

The stamps of such rich perspectives are reflected in the broader work of the IMF Research Department, and of the Monetary and Capital Markets Department. Importantly, as a community we think about the design, scope, and efficacy of policy toolkits available to countries, and frameworks for when and how different tools are utilized.

The extensive work of the IMF on the Integrated Policy Framework (IMF 2020) is an important step forward. Countries face difficult tradeoffs in policy. Research and analytics inform the prospects and challenges around specific domestic tools—including macroprudential measures (MPMs), foreign exchange intervention (FXI), and capital flow management measures (CFMs). My remarks today also will discuss these tradeoffs and toolkits, working through insights around global liquidity.

Today, my remarks focus on the topic of global liquidity. In 2011, the Bank for International Settlements (BIS) defined two types of global liquidity (CGFS 2011):

Official liquidity is that component created by central banks.

Private liquidity refers to the funding conditions for the broader international economy. It reflects the behavior of the financial sector in providing cross-border and/or foreign currency financing .

This private liquidity is my focus. It is proxied by the volumes of financial flows, largely intermediated through global banks and nonbank financial institutions, that can be reallocated at relatively high frequencies (can be intra-day or even intra-month).

Global liquidity is central to international macroeconomics, especially around international spillovers, monetary policy, capital flows, and credit provision. Within this space, my perspective is one shared by many previous Mundell Fleming Lecture presenters — with exchange rates determined in response to international capital flow pressures, and with financial factors the dominant driver. I take the position that global liquidity is central to the financial stability considerations.

Two drivers of this private global liquidity are monetary policy changes, including those from the US, and risk conditions. In recent years, both have received attention in previous Mundell Fleming Lectures.

Helene Rey's influential works including at the 2013 Jackson Hole meeting (Rey 2015) and the 2014 Mundell Fleming Lecture (Rey 2016) raised important challenges about country toolkits. That US monetary policy receives attention in discussions of international spillovers and the global financial cycle is not surprising, given the centrality of the US dollar in the international financial system. Indeed, there are channels through which the monetary policy and risk drivers overlap, including through the risk-taking channel of monetary policy.

Ben Bernanke in his 2015 lecture called for more work on understanding cross-border financial linkages that reflect destabilizing spillovers, as opposed to more benign factors (Bernanke 2017). Later the whole of the 2017 Annual Research Conference highlighted different aspects of such spillovers.

Ragu Rajan, in his 2018 lecture discussed consequences of such spillovers for foreign countries based on his work with Douglas Diamond and Yunzhi Hu (Diamond, Hu, and Rajan 2020).

My lecture has a particular emphasis on risk conditions as a driver of global liquidity. A key theme of my lecture is that volatility of global liquidity is associated with the vulnerabilities of and constraints on institutions participating in international financial markets. I will make a few key points from the vantage points of data at different levels of disaggregation by country, by types of flows, and across individual banks. I will conclude by talking about toolkits, building on the dedicated focus of the last decade.

Before I spell out my main points, some concept definitions are in order.

Prudential policies include so-called micro-prudential work done within countries to make individual financial institutions, more robust. We generally discuss prudential policies with respect to banking organizations, but this limitation is not required. The supervision and regulation of banking organizations includes a focus on how risk is managed, on the buffers that institutions have against types of risk, and on the approaches for recovery and resolution if the banking organizations get into trouble.

Macro-prudential work is about managing the cycle through tools that can target specific sectors or financial activities. The so-called macro-prudential focus certainly appeared on some radars early in the 2000s. Here at the IMF, in 2001 the conversation in front of the Executive Board was around furthering the compilation, use, and analysis of macroprudential indicators (MPIs) of the health and stability of financial systems in the light of experience gained to date (IMF, 2001}. The early focus on macroprudential indicators, however, was more closely aligned with early warning indicators than with a toolkit to directly influence the structure of financial activity.

In the aftermath of the global financial crisis, efforts shifted toward developing toolkits to manage financial conditions associated with excessive booms and avoid damaging busts in credit availability. Macro-prudential policies, as well as capital flow management tools, have received considerable attention.

My lecture today emphasizes a few main points that are relevant for both research and policy:

- Prudential policies dampen the amplitude of global financial cycles.

Here my key message has a focus on the home country of the financial institutions. The global regulatory community focused on large and internationally active banks after the global financial crisis. Strong micro-prudential policies and supervision have enhanced risk absorption and improved risk management. I will argue that banks with higher capitalization and better liquidity are associated with a lower amplitude response of cross border lending to deteriorating risk conditions. If large banks fail, improved recovery and resolution frameworks should shorten periods of disruption and unintended consequences. Overall, I will argue that more robust institutions in international financial flows relax some of the tight tradeoffs articulated in international monetary and financial stability trilemmas.

- Appropriately targeted policy requires a layered approach using granular data.

Analytics using granular data on financial flows inform the constraints, the institutional features, and the amplification channels that are relevant for designing effective policy. In the case of global liquidity, granularity also means considering the players -- those agents that are in need of financing, and the composition of creditors and investors.

This type of granular perspective has motivated some of the important work presented by Hyun Song Shin, as discussed in his 2011 Mundell-Fleming Lecture (Shin 2012). Hyun's contributions with Tobias Adrian take aim at understanding frictions and value at risk constraints in global banks (Adrian and Shin 2008), (Adrian and Shin 2010). Hyun's work with Valentina Bruno (Bruno and Shin 2015) highlights the financial channel of exchange rates working through banks. Both of these approaches are embedded in active agendas of researchers around introducing financial frictions into models.

The Bank for International Settlements and other institutions are active in collecting some of this granular data from central banks. Institutions are investing in even more granular collections and associated repositories. Insights from analyses of granular data increasingly contribute to our understanding of mechanisms and frictions at work in shaping the dynamics of capital flows across borders. This type of granularity even shapes how we should talk about groups of countries and their respective policy challenges. And we learn where we have blind spots.

We often talk about spillovers from home or source countries active in the international financial system. In this lecture, the granular data approach focuses attention on the supervision and regulation in the home countries of providers of global liquidity.

- Risk migration occurs within global liquidity flows, including in response to home country enhanced bank regulation and supervision. The increasing role of nonbanks could threaten some of the gains achieved in weakening the response of global liquidity to changes in risk conditions.

Some of the global liquidity flows —including the riskier projects and borrowers— have migrated away from funding provision through banks toward more market-based financing. Nonbank financial institutions now play important or even dominant roles in some global liquidity flows. Nonbank financial institutions consist of a broad spectrum of agents distinguished by the riskiness of their projects, their business models, their collateral holdings, leverage, and access to sources of funding.

This shift in funding composition can potentially undo some of the recent progress made on dampening shock amplification after the global regulatory communities focused on large and internationally active banks following the global financial crisis.

- The toolkit: Policy tradeoffs in destination countries for global liquidity are improved when participating institutions have better risk management and risk absorbing capabilities. The approach to banks has been developed, the approach for non-banks is less so.

These points underscore the importance — in an international context —of progressing on the largely domestic country efforts to address the vulnerabilities associated with some classes of nonbank financial institutions. Weaknesses and systemic risks propagate across borders, and domestic policy has externalities. Developing effective liquidity facilities for the official lender of last resort function, associated with official provision of global liquidity, also plays a role.

- Open questions: What is the endgame for risk migration? What is the right mix of (international) debt and equity flows, and how is this ideal mix achieved?

Equity markets can quickly adjust to shocks through asset prices. Equity owners absorb losses and volatility. Institutions and tax codes can favor debt financing. What is the right mix domestically, and how does this interact with global liquidity?

- Global Liquidity

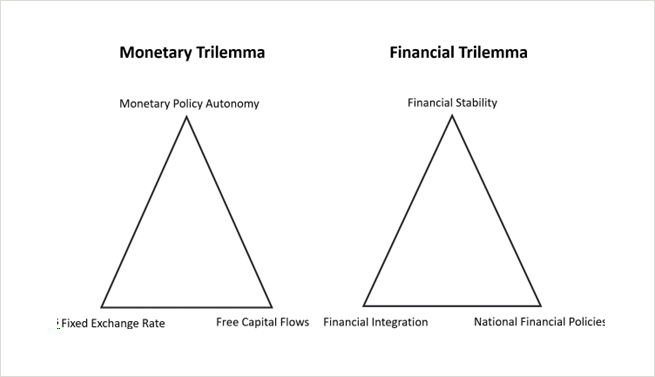

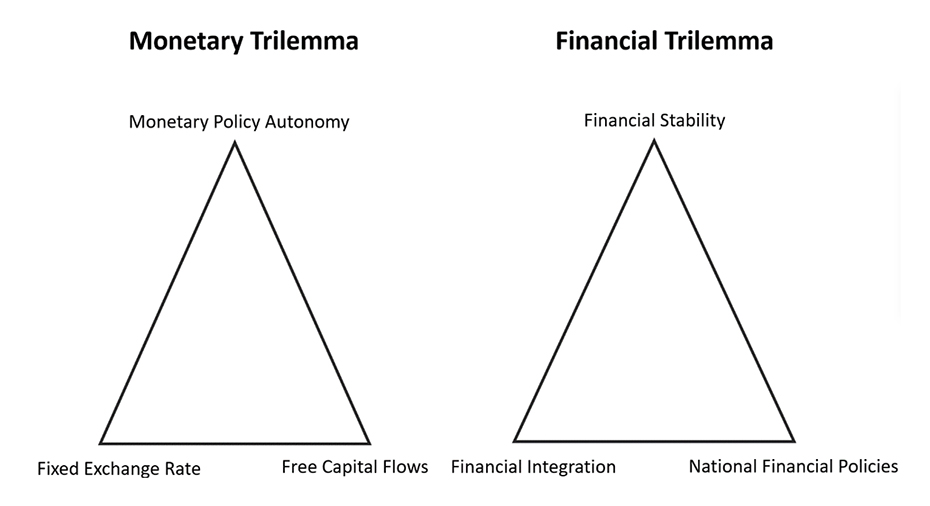

Arguments about global liquidity tie closely to overall capital flows and relate to the classical Monetary Trilemmas faced by countries. The well-known Monetary Trilemma posits the incompatibility of three economic features: monetary policy autonomy, maintaining fixed exchange rates, and having free and open international capital flows. Maury Obstfeld has provided empirical evidence that some monetary policy autonomy exists, including for emerging markets, especially for countries with flexible exchange rates. Countries with flexible exchange rates have better economic outcomes relative to countries under fixed exchange rate alternatives, even if complete achievement of domestic goals is not accomplished.

Additional challenges for policy autonomy are highlighted around the Financial Trilemma, in which Dirk Schoenmaker (2005 and 2011), builds on the more general principles of extensive domestic objective incompatibilities in a globalized world as argued by Dani Rodrik (2000). This Financial Trilemma brings into focus the conflicting nodes in the international financial stability realm that are sharpened by the substantial growth in cross-border financing over recent decades. In this case, the three mutually incompatible nodes are: financial stability, nonintervention in cross border financial flows, and national control over financial supervision and regulation.

At the IMF 15th Annual Research Conference on "Exchange Rates and Financial Globalization," Obstfeld (2014)discussed how financial stability policy is harder in open economies and financial fragility is more pronounced when agents choose not to hedge foreign dollar credits.

Obstfeld (2014) provides some ingredients of a more efficient international system, including:

- Sound domestic macroprudential policies (addressing inadequacy of monetary policy alone).

- Domestic regulatory control over large foreign banking organizations (FBOs).

- Since full coordination politically impossible, rules of the road for capital controls, if they are at times needed to address nation-specific issues.

- Enhanced facilities for international liquidity support in key currencies – to counteract downsides of gross reserve accumulation.

- More equity, less debt – well underway for EMEs.

Considerable progress has been made in developing and implementing the integrated policy framework here at the IMF. Regulators have also made some progress on the banking side, as I will discuss. It also has been made on capital control frameworks and enhanced facilities. At least as pertains to domestic macroprudential policies, one issue with effectiveness is that some parts of the toolkit are applied to specific types of institutions — for example banks —instead of activities.

More than a decade ago, the potential for risk migration was anticipated by researchers.

Jonathan Ostry, Atish Ghosh, Marcos Chamon and Mahvash Qureshi (2012) were early in the space of exploring the empirical consequences of macroprudential and capital control policies using data for 51 EMEs for the period 1995 through 2008. They found evidence of effectiveness for indicators of financial fragility. However, they also noted the difficulty of using macroprudential policy effectively when activity can migrate to unregulated venues.

Valentina Bruno and Hyun Song Shin (2015) observed that "the shifting patterns of financial intermediation means that tools geared toward the regulated banking sector have diminished efficacy" on the procyclicality of the financial system.

Maury with Alan Taylor (2017) emphasized the importance of focusing more on rapidly evolving financial markets, as risky activity was being pushed outside the perimeters of regulation.

Helene Rey (IMF 2017)called for a "research agenda for the Global Financial Cycle [including the] source, propagation, amplification mechanisms, endogenous risk build ups; Models with heterogeneous intermediaries and moral hazard (risk-taking not properly priced) …(among other things); Ex ante: Regulatory policies, Micro and macro prudential policies, capital flow management policies, … policies subsidizing debt."

All of Maury's ingredients will come up in the rest of this lecture. I will set up issues pertaining to the trilemma and the ingredients by considering the relationship between global liquidity and risk conditions. I will present evidence at different levels of data disaggregation, and ultimately make arguments about the roles of prudential policy and then the challenges from risk migration.

International capital flow pressures manifest as an excess demand for foreign currency relative to domestic currency. Global liquidity is a big portion of these flows.

Exchange rates are frequently used as indicators of these international capital flow pressures. However, some countries through central banks or finance ministries, at some times, meet excess demand for foreign currency by using foreign exchange intervention (FXI) instead of letting all the international capital flow pressure materialize in the depreciation. Similarly, when there are appreciation pressures on currencies, some central banks accumulate official foreign exchange reserves instead of realizing the full currency appreciation. In these cases, the exchange rate is no longer a sufficient statistic for international capital flow pressures, across countries and over time.

The new Exchange Market Pressure (EMP) index from Signe Krogstrup and I (Goldberg and Krogstrup 2018) includes the actual rate of currency depreciation or appreciation that occurs, along with contributions of both FXI conducted and monetary policy rate changes. But FXI is a quantity, for example billions of euros or USD, while currency depreciation is a rate. How can they be added up?

We derive the factor that converts how much currency depreciation was avoided by that FXI. The derivation starts with the standard balance of payments accounting, which captures the flows associated with net exports, interest payments on foreign debt and interest earnings, and changes in gross foreign asset and liability positions. FXI is the residual of all the other currency flows across borders for a country at a point in time.

As the exchange rate influences some of these flows, we work through how much of a change in the exchange rate — working through mostly financial channels— would have been needed to generate such an excess demand for foreign currency. This gives the conversion factor. It represents the quantity of currency depreciation avoided by every billion dollars or euros of FXI is country and time specific and depends on features like country-specific gross foreign assets and liabilities, the currency denominations of these positions, and the sensitivity of different types of investors to shocks.

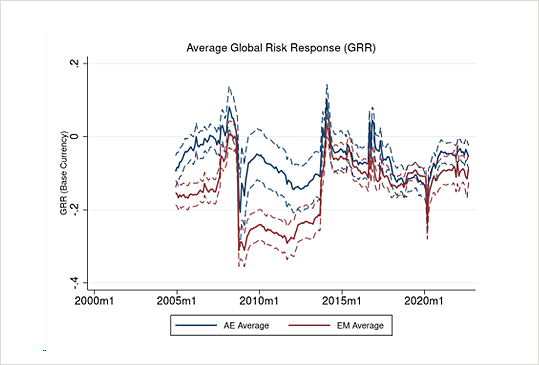

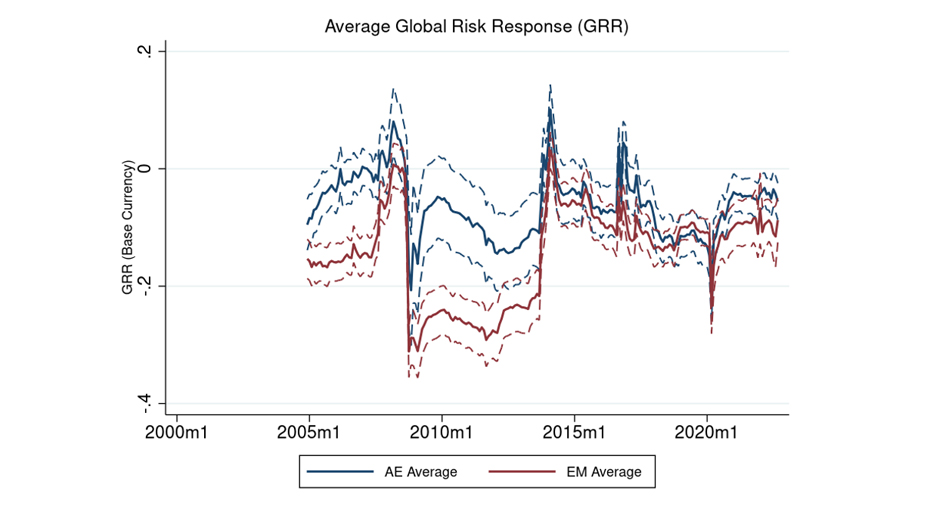

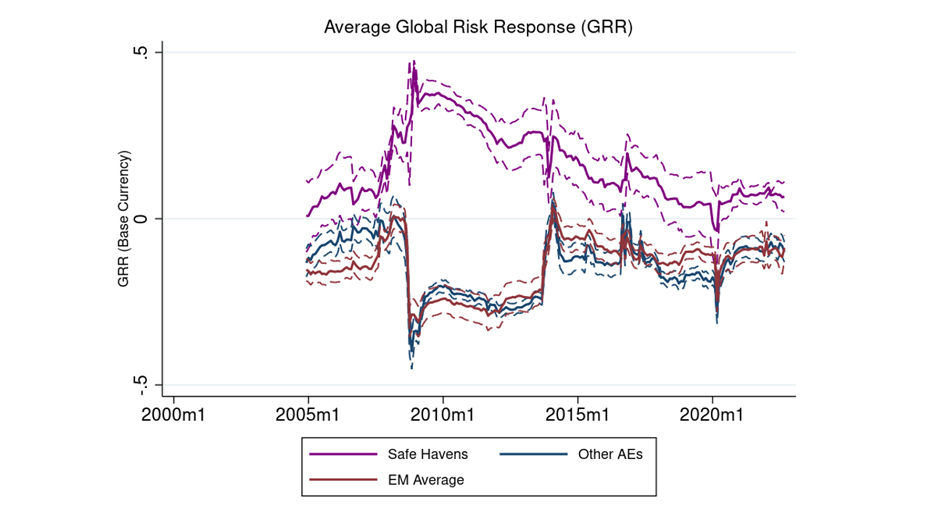

We compute monthly series for the EMP for a large group of countries. And we use this to demonstrate the evolving risk sensitivity of international capital flow pressures. Our Global Risk Response (GRR) series is a rolling 5-year correlation between the EMP and a measure of risk sentiment (in this case the VIX).

This slide shows in blue the averages across advanced economies at each date, along with a standard error band showing variation across countries and shows in red the comparable averages across emerging market economies.

This exhibit demonstrates a broadly accepted characterization. Increases in the VIX elicit a much greater risk off pressure on emerging market currencies - negative values are the tendencies of a currency to depreciate when risk sentiment deteriorates and the VIX is higher. These depreciation tendencies are stronger across emerging markets compared to advanced economies. Across these two groups of countries the differences in risk sensitivities are no longer so pronounced.

This inference is misleading. And it provides a first take of why looking at granular data is helpful.

For context, the past decade has focused our attention on safe haven properties of some currencies, with the dollar associated with convenience yields and the US considered a liquidity provider or global insurer. Many participating in this conference have contributed insights on this topic.1 Some other currencies also exhibit the so called "safe haven" currency characteristics, as these countries are net recipients of global liquidity flows or experience similar international capital flow pressures as the US dollar as risk conditions deteriorate.

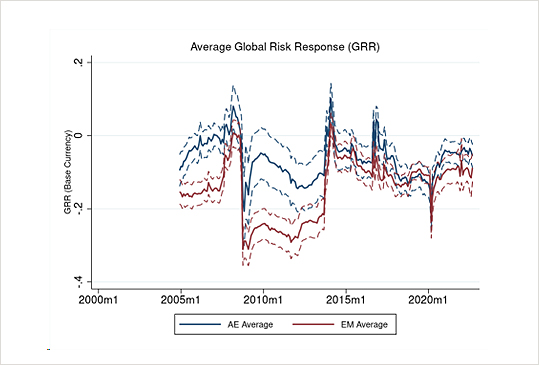

The next exhibit separates these so-called "safe haven" currencies from the broader group of advanced economies. Now we have average GRR values for two categories of advanced economies — with and without the "safe haven" feature — and have the average GRR for emerging market economies.

Abstracting from the so-called safe haven currencies, other advanced economies and emerging markets exhibit similar risk sensitivities. Advanced economies are not appropriately combined into a single category when considering policy challenges from risk-induced international capital flow pressures. The risk sensitivity for the currencies of other advanced economies and those of emerging market economies are quite similar after the GFC. Meanwhile, risk sensitivities have trended downward for the so-called safe havens.

Why? For answers, it is important to understand the composition of players in global liquidity flows.

Increasingly granular data will now help us to understand drivers of these reduced sensitivities and to gain insights on whether this status of lower risk sensitivity is likely to persist. It is helpful to have a schematic in mind as we consider the players.

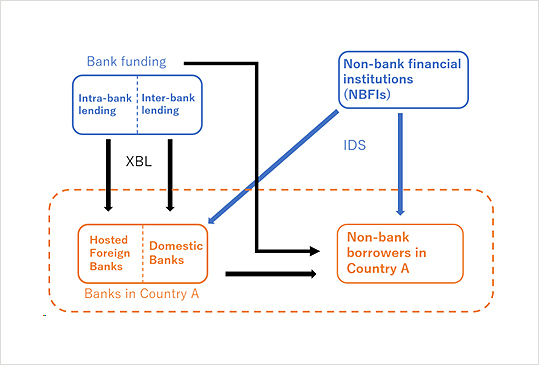

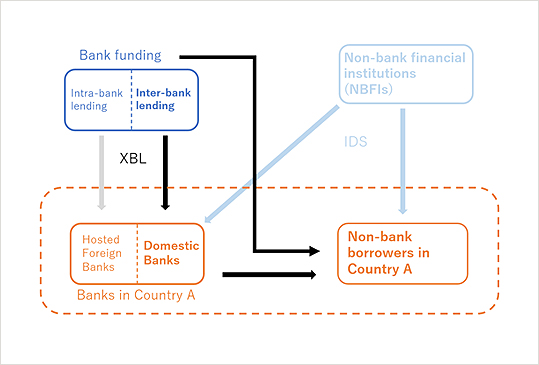

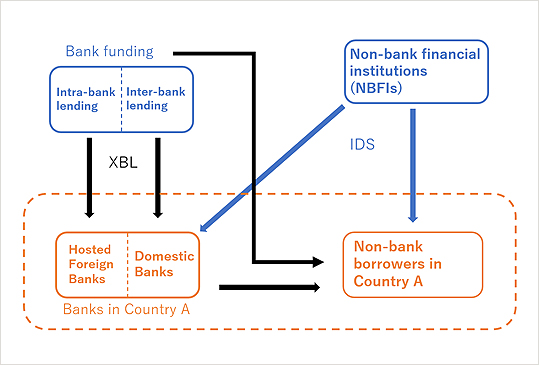

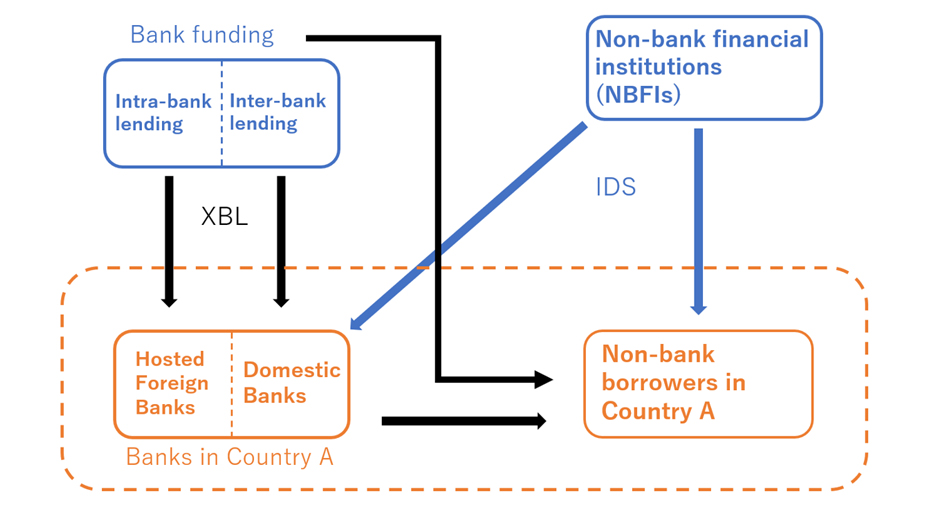

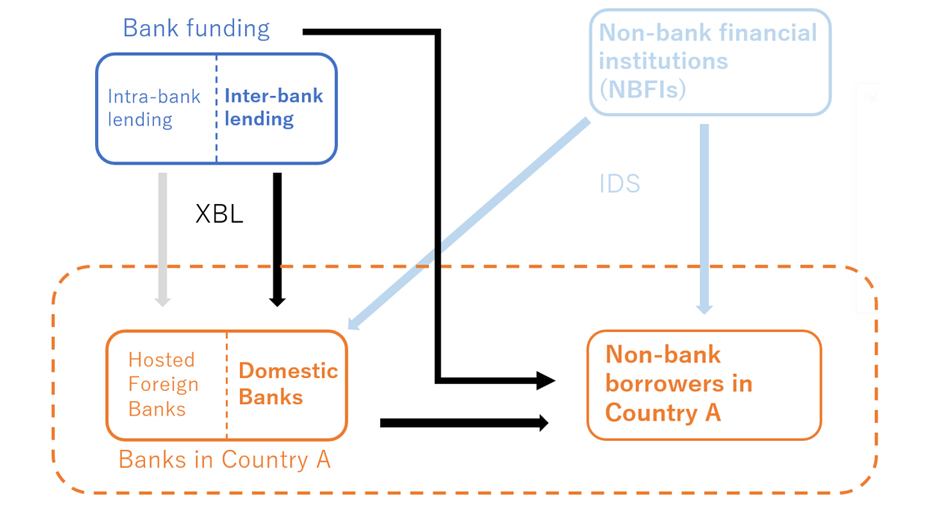

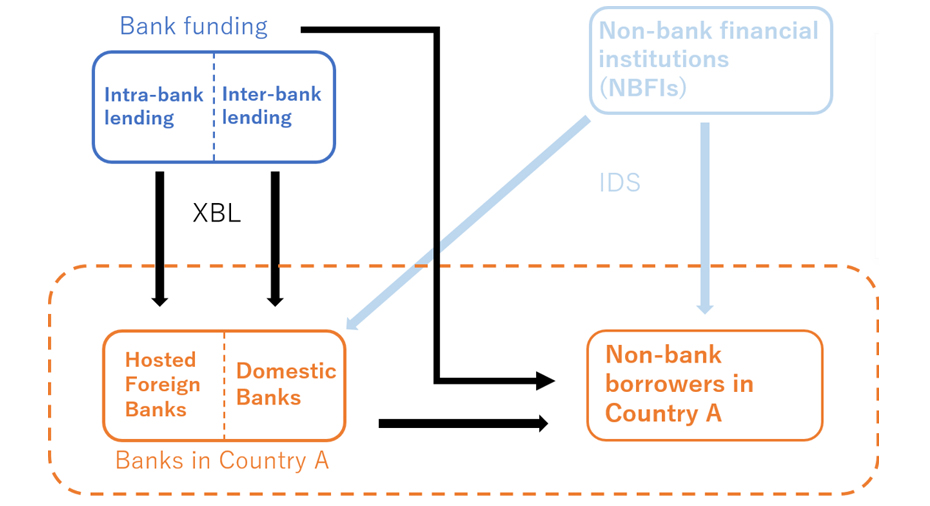

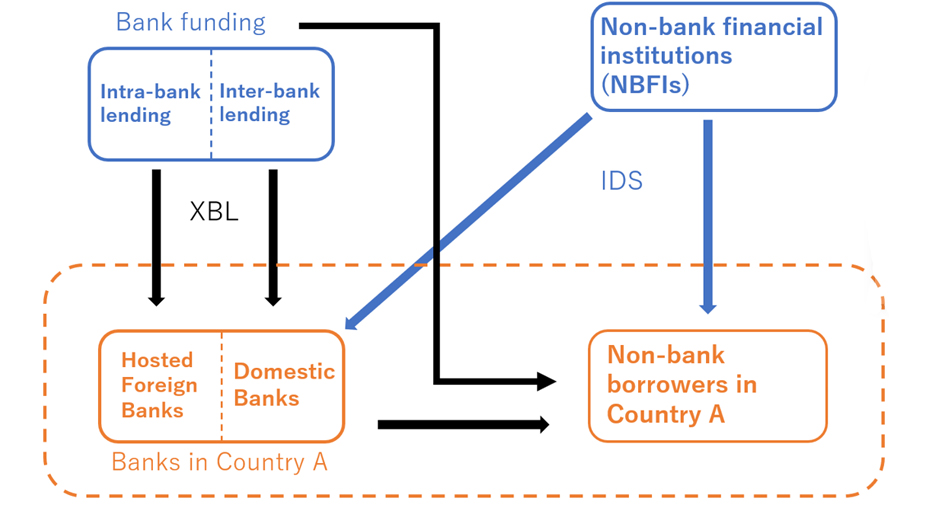

This schematic is intended to capture the key elements of global liquidity. The boundaries of Country A are indicated by the dashed orange lines. Within country A are banks, on the left, and all others in need of funding on the right. The global liquidity flows to borrowers in a Country A can be intermediated through banks (upper left) and through non-bank financial institutions (upper right).

Cross-border loans (XBL) are made by the internationally active banks to domestic banks. Internationally active banks also directly fund non-bank borrowers in country A. This funding can take the form of sovereign loans or syndicated lending to large non-financial corporations, exporting and importing firms, and leveraged non-bank financial firms.

Some global banks also engage in cross-border lending to their branches and subsidiaries located in Country A. Intra-bank lending is how global banks manage liquidity across parts of their organizations around the world. The hosted banks then provide loans and services within the borders of country A.

The right side of this graphic shows the role of global players in the non-bank financial intermediation space. Funding through non-bank financial institutions (NBFIs) is sometimes described as market-based finance. This can be through purchasing international debt securities (IDS) that are issued by banks or by nonbanks within country A. The purchasers of these securities tend to be pension funds, insurance companies, money market funds, and hedge funds.

How large are these different types of flows?

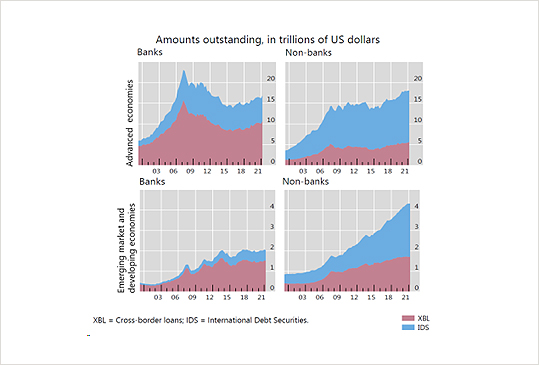

My recent research with Stefan Avdjiev, Leonardo Gambacorta, and Stefano Schiaffi (2022) expands on earlier work we published in 2020 in the JIE (Avdjiev, Gambacorta, Goldberg, Schiaffi 2020). Our current analytics look at BIS data on cross border loans and international debt securities, aggregated at the country level, with series that cover 44 lending countries and 64 borrowing countries, 2000 through 2021.

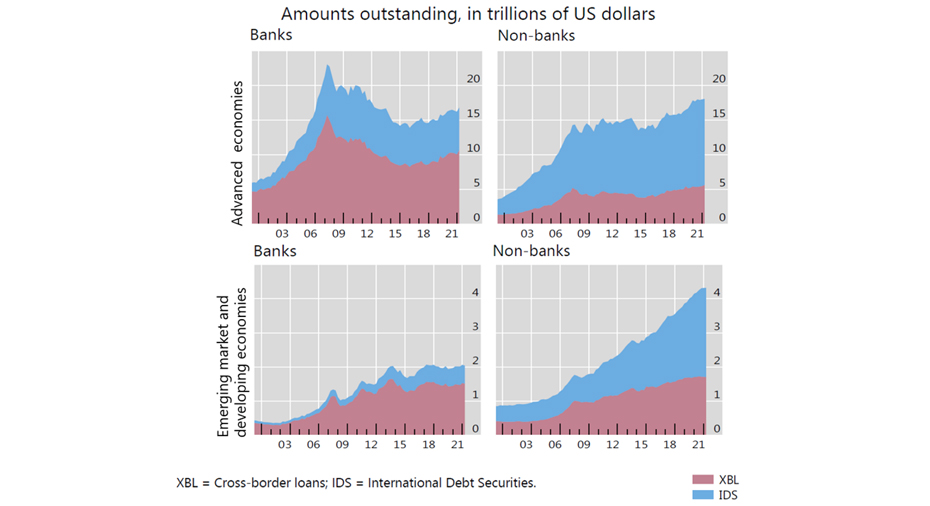

These exhibits show the evolving composition of bank-based funding and market-based funding for borrowers in advanced economies (top panels) and emerging markets (bottom panels). We separate the banks as borrowers (left panels) from the nonbanks as borrowers (right panels). Red blocks show outstanding XBL. Blue blocks show outstanding IDS.

Focus your attention on the left panels, which depict how bank borrowers are financed internationally. Banks in both advanced economies (on top) and in emerging markets (on bottom) have had relatively steady positions in total global funding in recent years. Cross-border loans (represented in red) are the largest form of international funding for banks.

Focusing your attention on the right panels, the most dramatic shifts in the composition of global liquidity are for non-bank borrowers. This change is evident both within advanced and emerging market economies. While banks have experienced moderate shifts in funding sources, nonbanks have tilted sharply toward market-based finance.

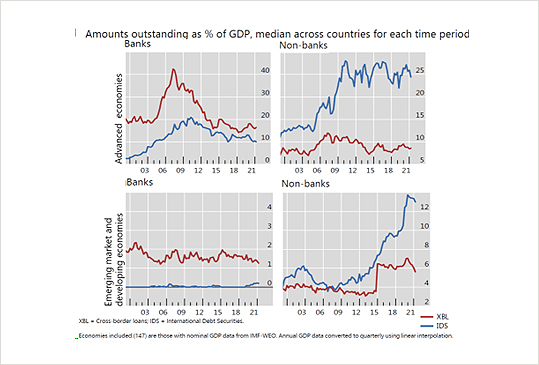

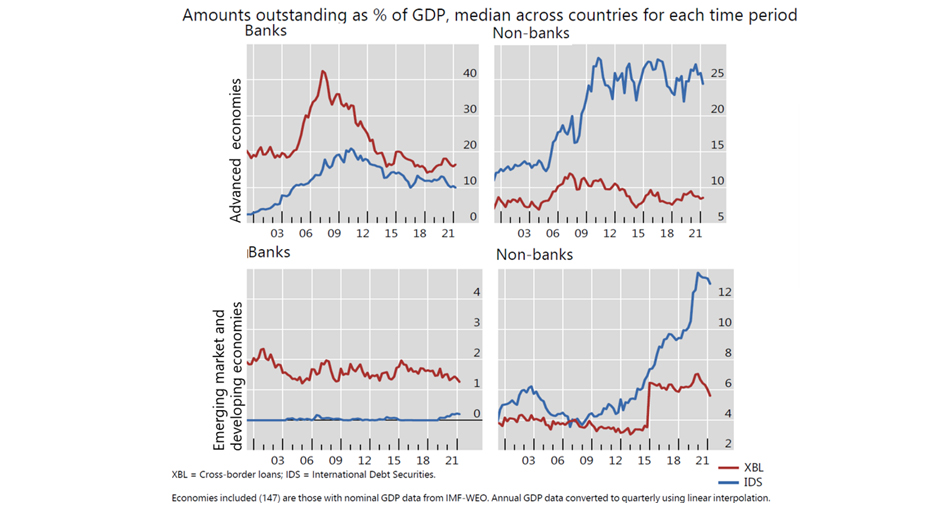

Next, the same data are deflated by GDP in each country at each quarter. We then consider the medians across countries and by date. Post GFC, the median advanced economy has international debt securities issued by nonbanks financed at about 25 percent of GDP, while the median emerging market economy has experienced sharp increases over a decade from around 5 percent of GDP to 13 percent of GDP.

Let's go back to big picture, and back to Maury Obstfeld, as he so often places lessons in the context of international financial history. In 2005, Maury and Alan Taylor published their book on Global Capital Markets (Obstfeld and Taylor 2005) in which they presented a stylized visualization of capital flow history from the mid-1800s to 2000. The first era of financial globalization occurred prior to 1914, then collapsed during the interwar period. The world economy experienced the second era of financial globalization from 1980 through 2000.

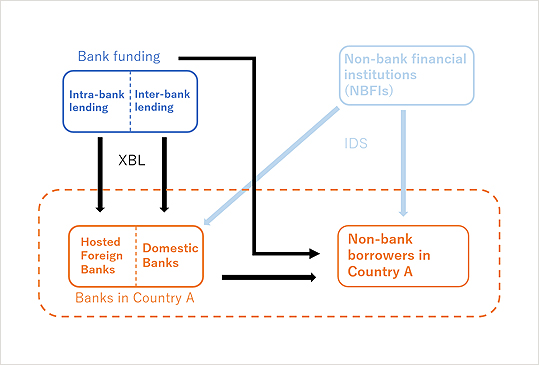

Next, I provide my own brief history of the period since 1980. For this purpose, I return to the stylistic diagram introduced earlier. The period from 1980 through the present will be divided into 3 episodes, also helping to motivate a bigger and durable point about risk migration in global liquidity.

Episode 1 - 1980s to early 1990s: Global Liquidity flows started out bank-based, and to sovereign borrowers. This is reflected in the pattern of bold black arrows.

Episode 2 - mid 1990s through early 2000s: Often following crises, countries liberalized their capital accounts and permitted more participation of foreign banks in the local economies. Global banking expands through branches and subsidiaries in foreign locations, and then direct lending increases to other nonbank customers. Other banking services also were more broadly provided. Global banking organizations became more complex with many legal entities as part of these financial conglomerates. Plus, there was some increase in the role of NBFIs.

Episode 3 – Post GFC to the present: The last and current era is a period of expansion of rapid global liquidity flows directly to non-bank borrowers and an increasing role of NBFIs. Part of this arose as regulation generated with risk migration away from banks and technological changes also occurred.

Next, our analytics use the borrower type and funding type granularity by country over time to explore evolving risk (and monetary policy) sensitivity over time, along with drivers of these changes. Sensitivities of flows are explored relative to the VIX. However, robustness has been done in some parts of the work to other measures —for example using the RORO measures of Chari, Dilts Stedman and Lundblad (2020) and the risk sentiment from Bekaert, Engstrom and Xu (2021).

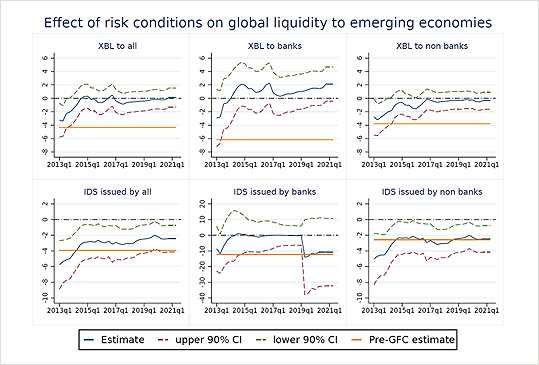

These next slides draw on my new research with Stefan Avdjiev, Leonardo Gambacorta and Stefano Schiaffi (Avdjiev, Gambacorta, Goldberg, Schiaffi 2022) and our earlier work in the JIE 2020.

The data cover IDS and XBL, by bank and non-bank borrowers. Analytics consider characteristics of source country banking systems and composition of NBFI types in inflows, from the perspective of the borrowing country.

The econometrics: estimate sensitivity to global factor components: change in U.S. federal funds rate (or shadow policy rate), risk sentiment (VIX), global GDP growth; control for local conditions: GDP growth, sovereign rating, capital account openness; estimate sensitivity pre-GFC and patterns post-GFC; separate borrowers by "safe havens", other advanced economies, and emerging markets; and test for drivers of sensitivities, including composition and characteristics of banking systems and NBFIs.

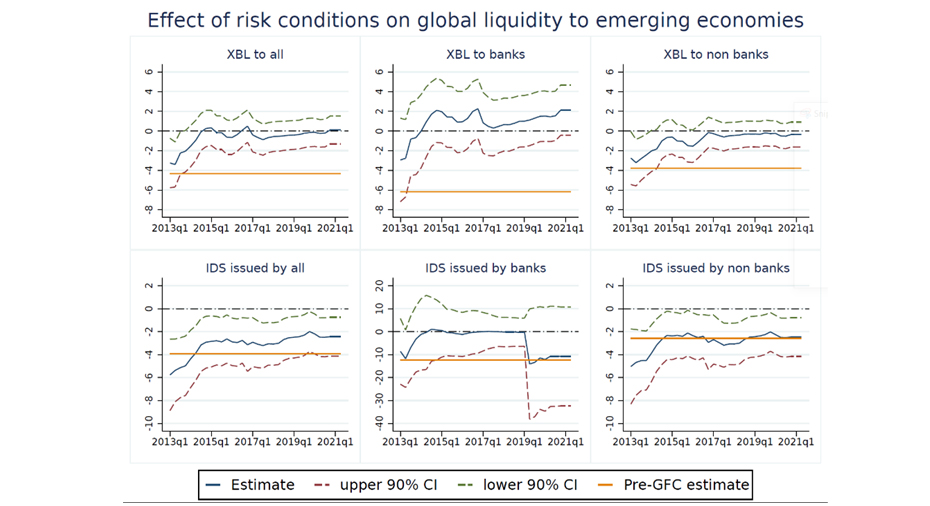

I illustrate findings applied to granular data at the country and funding type levels for EM borrowers. In the exhibit below, the horizontal orange lines are the pre-GFC sensitivities to risk. The blue lines are the post GFC sensitivities, sequentially adding quarterly observations. These blue lines are surrounded by a 90 percent confidence interval at each date.

The sensitivities to risk of different types of flows vis-a-vis borrower types have changed dramatically.

Across emerging markets, and across other country groupings (not shown), all borrower types have reduced cross-border lending sensitivity to the VIX. This is illustrated by the top panel of graphics, where the leftmost panel uses the total amount of XBL each quarter by country, the middle panel shows the perspective of banks as recipients of interbank funding, and the right panel provides the perspective of non-bank borrowers.

These risk sensitivity results through bank lending stand in contrast to patterns in market-based funding for bank and nonbank borrowers. Risk sensitivity of IDS has not declined and exhibit considerable heterogeneity across borrowing countries. This type of funding has grown in importance. It is also less transparent, and more heterogeneous, as I will shortly discuss.

There are important differences across so-called safe havens and other advanced economies (not shown here). Pre-GFC, cross-border lending to banks located in all groups of countries contracted when risk sentiment deteriorated. After the GFC, on average funding flowed into the safe haven country banks and non-bank borrowers when deteriorations in risk conditions occurred.

In sum, the post GFC period has been characterized by been dramatic changes

- A few advanced economies have emerged as "safe havens"

- Advanced economies are better understood by separating out the so-called safe haven experiences from other advanced economies.

- The role of market-based funding has increased, especially for nonbank borrowers.

- Risk sensitivities of global liquidity flows through banks have declined.

- NBFI funding remains risk sensitive, with considerable heterogeneity in types across borrowing locations.

- Prudential Policy Spillovers Across Borders

What is behind this changing pattern of risk sensitivity across countries and over time? The next body of work points to stronger prudential policy and official liquidity facilities in reducing the amplitude of response of global liquidity to risk deterioration. Key findings are based on considering risk sensitivities in post GFC, both compared to pre GFC and over time (through 2021 data).

Better capitalization in banks is the major contributor to less risk sensitive XBL. The amplitude of risk transmission across borders is sharply magnified through banks that are less well capitalized. The role of bank capitalization is particularly important for EM borrowers.

Additional stabilizing effects have come from compositional changes within XBL activity. Less well capitalized banking systems lost market share after the GFC, as they focused more on balance sheet repair. In addition, the shorter term and more volatile cross-border flows vis-à-vis unrelated banks abroad (Interbank lending) has declined, increasing the relative importance of intra-bank lending.

Data limitations make it more difficult to be as conclusive about the characteristics of NBFIs involved in market-based funding. Our research uses two NBFI indicators: the asset share of NBFIs with high leverage and the asset share of NBFIs with high liquidity transformation.2 We do not have institution specific details on leverage, including for institutions involved in global liquidity flows. The results are much noisier.

In market-based funding of borrowers, risk sensitivity appears to be higher when higher leverage types of NBFIs account for larger shares of flows. The share of high leverage NBFI types associated with global liquidity inflows are quite different across safe havens, other AEs, and EMs. For EMs this share represents over 40 percent of the NBFIs, down from over 50 percent a decade prior. For other advanced economies, the share is considerably lower, down to about 20 percent in the past decade.

Research conducted through projects organized by the International Banking Research Network provides additional insights. Friederike Niepmann, Tim Schmidt-Eisenlohr and Emily Liu ( 2021) find that only banks that comfortably passed the CCAR (the Federal Reserve's annual Comprehensive Capital Analysis and Review) stress tests issued more loans to EMs borrowers. Banks also shifted their lending to safer borrowers within EMs in response to monetary easing, leaving the risk of their overall loan books unchanged.

Other studies find that prudential policy spillovers across borders depend on bank characteristics in source and recipient countries (Buch and Goldberg 2017). As there are Heterogeneous results across the different countries participating in this initiative, we reach general findings using meta-analysis. Spillovers occur internationally through bank lending. Country- and sector-specific dynamics documented by individual countries. Effects on lending differ with bank balance sheet characteristics and business models. Direct effects are not large on average.

Bank capital requirements are tied to migration of activity across banks/ banking systems. Banks with higher initial capital were poised to increase lending internationally, and sometimes pivoting from domestic loan growth, when foreign countries tightened their capital requirements. Changes in some prudential instruments spur market share repositioning across banks and foreign countries.

Recovery and resolution frameworks for large and systemically important banks have also played a role in changing risk sensitivity of banking organizations. My work with Ricardo Correa on US banks and the introduction of living wills shows that these large banks reduced their organizational complexity, but at the same time this altered forms of risk exposures ( Correa and Goldberg 2022)

New research also points to Central Bank Swap Lines and Funding Facility access as reducing risk sensitivity. When tail risk events in global liquidity occur, high stress episodes are reflected in higher cost of dollar funding facing borrowers in offshore markets. Some of the amplification effects arise as borrowers increase demand for liquidity due to meeting existing balance sheet funding needs or due to positioning towards more liquid positions. At least from the perspective of liquidity for such insurance purposes, access to lender of last resort and liquidity facilities should weaken the amplitude and amplification of some global liquidity responses to extreme risk events.

In dollar funding, the Federal Reserve's swap lines with central banks and the Foreign and International Monetary Authority (FIMA) repo facility - introduced in March 2020. By reducing some of the tail risk on dollar funding costs in systemic events, access to such facilities support continued credit provision and reduced amplification effects when large shocks hit global markets.

Analysis conducted with my colleague Fabiola Ravazzolo, using data during the early months of the pandemic in 2020, explores if the risk sensitivity of different components of global liquidity flows are differentiated across countries, and decline with facility access (Goldberg and Ravazzolo 2022 ). Analytical results support the conjecture that facility access in a large risk event stabilizes credit flows through banks and bond funds, but also depends on the features of funds. 3

These types of findings reinforce the point about understanding the heterogeneity of nonbank financial institutions, as well as types of mutual fund flows. Recent analytics by Anusha Chari, Karlye Dilts Stedman, and Christian Lundblad (Chari, Dilts Stedman, and Lundblad 2022) show extensive heterogeneity across bond and equity funds, as well as across institutional funds versus retail funds, in response to risk levels and risk aversion, with distinctions sorting along passive versus active funds and along the composition of these funds.

- Risk Migration and Toolkits

My last two themes focus on risk migration and toolkits. Think back to the stylized history of the past 40 years, and to the drivers that I have presented. Pre-GFC, liberalized access by global banks shifted some XBL to local lending. More credit access to smaller, riskier local borrowers. Plus, global bank liquidity allocation across organizations responds to risk. Lending by branches and subsidiaries is less risk sensitive than XBL. Intra-bank lending more stable than inter-bank lending. When shocked, global banks follow pecking order on liquidity reallocation across foreign affiliates: core locations are more protected than periphery ( Cetorelli and Goldberg 2012 )

After the global financial crisis those internationally active banks with stronger balance sheets and risk absorbing capacity expanded market share relative to banks that had to focus more on balance sheet repair. Over time, the frameworks focused on large and systemically important banks require more capital to be set aside in association with riskier borrowers. This led to some migration of those financing activity to market-based finance through NBFIs. This likely was aided by prudential developments including enhanced recovery and resolution frameworks, reduced some of the organizational complexity of global banks (Correa and Goldberg 2022).

Regulation and innovation fuel both NBFI expansion and their locations in cross-border financial centers. Pamela Pogliani, Goetz von Peter, and Phil Wooldridge (2022) find that NBFIs now account for the largest share of intermediation via cross-border centers. NBFIs locate more in cross-border financial centers with less stringent regulation. Funds are channeled across borders often via entities with a minimal physical presence, such as booking offices, special purpose entities (SPEs) and shell companies.4

Extensive work on toolkits has focused on managing priorities, conditional on characteristics of global liquidity. My main lesson is that Trilemmas – both the monetary trilemma and the financial trilemma - bind less under stronger foreign prudential policies. This is a positive externality.

This insight reinforces importance of: Continued focus on risk management and ample risk buffers of global banks – positive global externalities for XBL; liquidity management within global banks helps fund more information-intensive, relatively stable local lending by affiliates. However, more peripheral locations are less protected (even less so by XBL); and liquidity facilities by central banks: reduce amplification of strains, enable liquifying instead of liquidating official reserve assets.

It also emphasizes additional considerations, as the IMF Integrated Policy Framework has a focus on recipient country policy. Can the framework explore introducing thresholds on prudential strength of source countries? Or around characteristics of specific global liquidity providers?

The research community can collectively enhance this effort so that we collectively learn more about the mechanisms for transmission and amplification across specific types of institutions. Issues arise around institutional oversight and regulation, access to liquidity backstops with moral hazard risks, where procyclicalities arise in financing flows, differences in dynamics through new and old players in financial markets along with entry costs to intermediate and participate in liquidity provision, and differences in behaviors in normal times versus crisis periods when stresses are broad-based. In addition, the central banking community is working to understand how NBFIs contribute to monetary policy implementation, with details about the granular composition of the types of institutions including insurance companies, investment funds, and pension funds. While banks and NBFIs are discussed separately, there are interconnections with channels of shock transmission that are still not fully understood.

In the global liquidity environment, even if domestic toolkits are not complete, the tradeoffs in the Financial Trilemma should be improved if both global banks and overseas nonbank financial intermediaries abroad are more robust, without amplification effects that worsen the effects of shocks, whether associated with risk sentiment or other causes. From a borrowing country perspective, perhaps the future is one where every institutional provider of funding is rated, and there is a required diversification of providers as well as threshold rating of providers. Perhaps this type of approach can help deal with regulatory fragmentation.

As a final point, the international financial and research communities can collectively pose the question about the optimal composition of global liquidity flows. It is clear that funding should be somewhat diversified to minimize counterparty risk concentrations. A mix of domestically owned and foreign banks provide additional dimensions of diversification, as do diversified business models within banking organizations. However, less well developed is the optimal structure of debt versus equity.

V. Concluding remarks

I have argued today that prudential policies in the source countries of global liquidity are important for reducing the amplitude of responses to risk as transmitted across borders. Managing challenges from global liquidity has four key elements. First, appropriately target policy using a layered approach with granular data. Second, maintain a focus on strong prudential policies and effective supervision. Third, focus on features of liquidity facilities that help dampen the global financial cycle, but do not create moral hazard. Fourth, address the continuing challenges that arise from risk migration.

In addition there are many areas that are ripe for careful research and analytics. Among this is a forward-looking vision of what countries would target as an ideal structure of debt and equity in financing.