In order to support a successful transition away from U.S. dollar (USD) LIBOR, and as administrator of the Secured Overnight Financing Rate (SOFR), the Federal Reserve Bank of New York (New York Fed), in cooperation with the Treasury Department’s Office of Financial Research (OFR), is proposing to publish daily three compounded averages of the SOFR with tenors of 30-, 90-, and 180-calendar days. The New York Fed plans to initiate publication of these averages in the first half of 2020.1

In addition to these three SOFR averages, the New York Fed is also proposing to publish daily a SOFR index that would allow the calculation of compounded average rates over custom time periods.

The Federal Reserve Board and New York Fed convened the Alternative Reference Rates Committee (ARRC) to, among other reference rate reform objectives, recommend an alternative rate to USD LIBOR and to develop plans to promote the use of that alternative. In June 2017, the ARRC selected the SOFR as its preferred alternative to USD LIBOR to be used in new issuance of certain USD derivatives and other financial contracts. In April 2018, the New York Fed, in cooperation with the OFR, began publishing the SOFR and two other new reference rates based upon transactions in the market for repurchase agreements (repos) secured by Treasury securities. At a roundtable discussion in July 2018, the ARRC discussed the ways that publishing compounded averages of the SOFR could help facilitate adoption of the benchmark rate. These included increased reference in consumer loans and floating rate notes (FRNs), which, in turn, could encourage greater use of SOFR derivatives to hedge positions in these instruments. The ARRC subsequently released a white paper in April 2019 to help explain how an average of the SOFR can be used in cash products.

Compounding

The SOFR averages and the index, as proposed herein, would employ daily compounding, which should more accurately reflect the time value of money than a simple average.2 The use of compounding would also align with the International Swaps and Derivatives Association’s methodology for use of overnight rates in swap contracts, which may be preferred by issuers of SOFR-linked liabilities for hedging purposes.3 More accurate hedging, in turn, may also contribute to better market functioning.

Although compounded averages of the SOFR are already being incorporated into many financial contracts, a readily available source of standardized, published SOFR averages, in addition to a SOFR index, should encourage broader usage and further support the transition from USD LIBOR.

Consistent with the manner in which interest is treated in the derivatives market and how interest accrues in overnight repo transactions, interest would compound only on business days, as determined by the SOFR publication calendar. Simple interest would apply to any day that is not a business day, at a rate of interest equal to the SOFR value for the last available business day. In other words, when handling a typical weekend, the averages and the index would use the SOFR value from Friday (later published on the following Monday) for Friday, Saturday, and Sunday, multiplying that value by the three days, and compounding the rates/index once by that adjusted term. Holidays will be treated in a similar fashion.4 Furthermore, in accordance with broader USD money market convention, interest will be calculated using the actual number of calendar days, but assuming a 360-day year.5

The table below illustrates the proposed compounding methodology:

| SOFR Publication Date; Averages & Index Value Date |

SOFR Value Date | SOFR | Calendar Days Applicable | Compounding Methodology |

| Mon 4/2/2018 |

Fri 3/30/2018 |

N/A | N/A | 1 |

| Tue 4/3/2018 |

Mon 4/2/2018 |

a | 1 | (1)(1 + a x 1/360) |

| Wed 4/4/2018 |

Tue 4/3/2018 |

b | 1 | (1)(1 + a x 1/360) (1 + b x 1/360) |

| Thurs 4/5/2018 |

Wed 4/4/2018 |

c | 1 | (1)(1 + a x 1/360) (1 + b x 1/360) (1 + c x 1/360) |

| Fri 4/6/2018 |

Thurs 4/5/2018 |

d | 1 | (1)(1 + a x 1/360) (1 + b x 1/360) (1 + c x 1/360) (1 + d x 1/360) |

| Mon 4/9/2018 |

Fri 4/6/2018 |

e | 3 | (1)(1 + a x 1/360) (1 + b x 1/360) (1 + c x 1/360) (1 + d x 1/360) (1 + e x 3/360) |

Note that, whereas the SOFR is published one business day following its value date (the day when overnight trades were negotiated), the SOFR averages and index are published on their value date. This approach aligns with the economics of the repo market, where the repo rate determines the cost of borrowing through the transaction’s maturity date. For the overnight repo transactions comprising the SOFR, the maturity date is always the next business day (when the SOFR is published), so the index and averages will always have a value date one business day later than the value date of the final SOFR observation included.

Averages

Three compounded averages based on the SOFR are proposed with tenors of 30-, 90-, and 180- calendar days and would be published each business day just after the publication of the SOFR at approximately 8:00 a.m. ET. These tenors are similar to the interest payment periods of most cash instruments and LIBOR-referencing derivatives.6,7

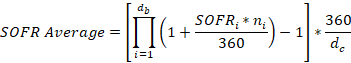

Each respective SOFR average would span the relevant number of historical calendar days, with the final value being the SOFR published that day (for example, for a typical Monday, the final SOFR used in the calculation of the compounded averages would be published that day, but would reflect activity from the previous Friday and be applied over three days).8 These values would then be compounded according to the following formula, consistent with the compounding methodology used for overnight indexed swaps:

Where:

- SOFRi = SOFR applicable on business day i

- ni = number of calendar days for which SOFRi applies (often 1 day, or 3 days for typical weekend)

- dc = the number of calendar days in the calculation period (that is, 30-, 90-, or 180- calendar days)

- db = the number of business days in the calculation period

- i denotes a series of ordinal numbers representing each business day in the calculation period

Index

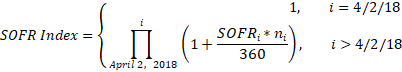

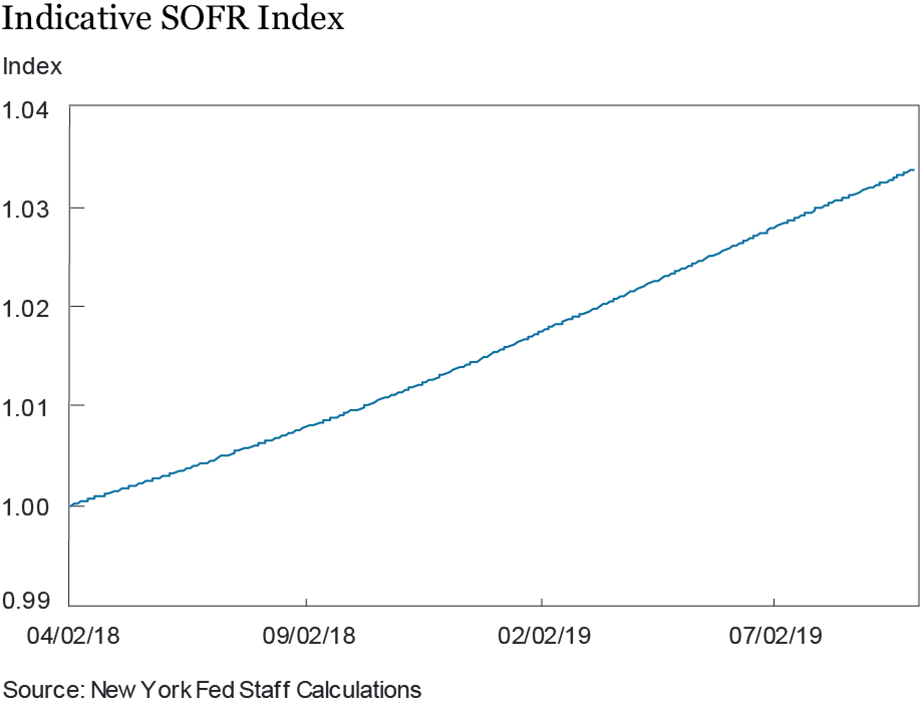

The SOFR index would measure the cumulative impact of compounding the SOFR on a unit of investment over time, with the initial value set to 1.00000000 on April 2, 2018, the first value date of the SOFR.9 The index would be compounded by the value of each SOFR thereafter. As a result, the first official published SOFR index value will reflect the effect of compounding the SOFR each business day since April 2, 2018.

On each day the SOFR is published, the SOFR index would be calculated as:

Where

- SOFRi = SOFR applicable on business day i

- ni = number of calendar days for which SOFRi applies

- i represents a series of ordinal numbers representing each business day in the calculation period

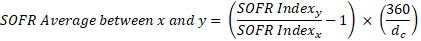

The SOFR index is a compounding sequence that allows investors to calculate compounded SOFR averages over custom time periods. To calculate the compounded SOFR average between any two dates within the SOFR publication calendar, one would only need to input the SOFR index values on those dates into the following formula 10:

Where:

- x = start date of calculation period

- y = end date of calculation period

- dc = the number of calendar days in the calculation period

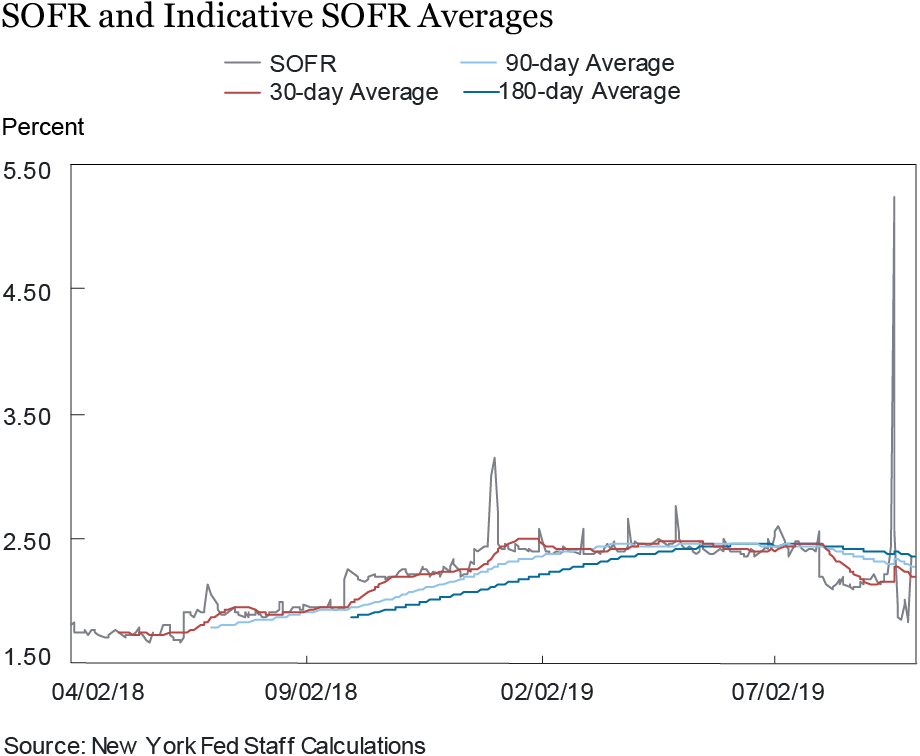

The figures below provide insight into how the SOFR averages and SOFR index would have looked based on historical values of the SOFR going back to April 2018. Indicative values, which should not be considered official published rates, can be found here.

Decimal Precision

The SOFR averages, as proposed herein, would be published as percentages rounded to the fifth decimal place (X.XXXXX%), consistent with convention in the derivatives market, while the SOFR index would be published as a number rounded to the eighth decimal place (X.XXXXXXXX).

Given that the proposed calculation of the SOFR index would reflect the same arithmetic as the proposed SOFR averages, rates calculated using the SOFR index with the same start and end dates as the SOFR averages should effectively produce equivalent results. However, due to the fact that the SOFR index will be rounded, term averages calculated from these rounded index values will not maintain the same precision as the compounded averages; analysis of historical data suggests minor differences from the published averages may occasionally occur at the fifth decimal place.11

Publication Time and Revisions

As is the case with the SOFR, the averages and index will be published each business day that is not broadly recognized as a holiday for secondary market trading of U.S. government securities. The averages and the index would be published on their own dedicated web page on the New York Fed’s public website, separate from the SOFR, shortly after the SOFR is published at approximately 8:00 a.m. ET. The SOFR averages and index would only be revised on a same-day basis (at approximately 2:30 p.m. ET) and only if either that day’s SOFR publication were also being revised or an error were discovered in the calculation of the averages or index.12

The calculation of the averages and index would rely solely on the published values of the SOFR. No new data collections will be required. Additional information about the SOFR and other Treasury Repo Reference Rates can be found here.

In the construction and publication of these averages and index, the New York Fed will endeavor to adopt policies and procedures consistent with best practices for financial benchmarks, to the extent appropriate, so that the three averages and index would be compliant with the IOSCO Principles for Financial Benchmarks (“the IOSCO Principles”). For more information about how the underlying SOFR complies with the IOSCO principles, please see the New York Fed’s Statement of Compliance.

Consistent with the IOSCO Principles and in accordance with its reference rates public consultation policy, the New York Fed requests comments on the above proposal to calculate and publish compounded averages of the SOFR and a SOFR Index. Comments should be submitted to the New York Fed by December 4, 2019 via email to rateproduction@ny.frb.org. Specifically, the New York Fed asks for responses to the following questions:

- Is the proposed calculation methodology, including the compounding approach, appropriate for calculating the averages and index?

- Are the proposed fixed 30-, 90-, and 180-day tenors for the SOFR averages appropriate, or should the published averages follow a modified following convention (which would not result in a fixed 30-, 90-, or 180-day count) or some other convention? Does the SOFR index appropriately address the need for calculating flexible period

averages?13 - In addition to the proposed tenors for the SOFR averages, are there any additional tenors that should be considered for publication? Please explain the purposes that such tenors might be used for.

- Are there any changes to the proposed decimal precision for the SOFR averages or index that should be considered?

- Are there any other changes to the averages or index as proposed that would make them more useful? For what purpose(s)?

- Are the proposed publication arrangements, including publication dates and times, appropriate to facilitate use of the averages and the index?