Last Updated: 11/25/2024

Information about the Effective Federal Funds Rate and Overnight Bank Funding Rate

- Primary Data Inputs for the EFFR and OBFR

- Data Contingencies for the EFFR and OBFR

- Data Exclusions for the EFFR and OBFR

- Calculation Methodology for the EFFR and OBFR

- Details on Publication and Revisions for the EFFR and OBFR

Information about the Treasury Repo Reference Rates

- Primary Data Inputs for the Treasury Repo Reference Rates

- Data Contingencies for the Treasury Repo Reference Rates

- Data Exclusions for the Treasury Repo Reference Rates

- Calculation Methodology for the TGCR, BGCR, and SOFR

- Calculation Methodology for the SOFR Averages and Index

- Details on Publication and Revisions for the Treasury Repo Reference Rates

- IOSCO Compliance

- Internal Oversight

- Methodology Changes

- Conflicts of Interest

- Questions and Complaints

Additional Reference Rate Data

Primary Data Inputs for the EFFR and OBFR

The New York Fed calculates the Effective Federal Funds Rate (EFFR) and Overnight Bank Funding Rate (OBFR) from daily transaction data reported under the authority of the Board of Governors of the Federal Reserve System on the FR 2420 Report of Selected Money Market Rates. For further information about the FR 2420, please see the following:

- FR 2420 Reporting Instructions

- FR 2420 Reporting Form

- Initial Federal Register Notice

- Final Federal Register Notice

- Initial Federal Register Notice on expansion of the FR 2420 to include Selected Deposits

- Final Federal Register Notice on expansion of the FR 2420 to include Selected Deposits

- OMB Supporting Statement and Four Public Comment Letters

The EFFR is calculated using data on overnight federal funds transactions provided by domestic banks and U.S. branches and agencies of foreign banks, as reported in the FR 2420.

The OBFR is calculated using the same federal funds transaction data that is included in the EFFR, as well as certain overnight Eurodollar transaction data and, as reported in Part D of the FR 2420, certain overnight “selected deposit” transactions that are placed at domestic bank branches. The included Eurodollar transactions are unsecured borrowings of U.S. dollars booked at international banking facilities and at offshore branches that are managed or controlled by a U.S. banking office. For U.S. branches and agencies of foreign banks, “managed and controlled” branches are defined by Reporting Form FFIEC 002S as those offshore branches for which the U.S. branch or agency has majority responsibility for business decisions. For U.S. banks, the managed and controlled branches represent offshore branches for which the U.S. office of the bank primarily manages the funding activity. The selected deposit transactions, which were added to the transaction base of the OBFR beginning on May 1, 2019, are U.S. dollar deposits in an amount of $1 million or more with a fixed term and a negotiated interest rate that are booked in U.S. offices of the reporting banks.

For both the EFFR and the OBFR, consistent with the FR 2420 reporting, overnight transactions are those settled on the same day as the trade date and maturing the following business day. Rates for transactions with greater than one business day to maturity or without a specified maturity date (“open transactions”) are not included in the calculation.

Data Contingencies for the EFFR and OBFR

On most days, the rates will be published based on data from the FR2420 report. If rates are published with reduced volume due to missing reporters or other circumstances, a footnote will be included with the published rate to indicate reduced volume. If the FR 2420 transactions are unavailable or deemed by the New York Fed to be incomplete and insufficient to publish a rate, the New York Fed may publish the rates using data obtained from federal funds and Eurodollar brokers. Under extraordinary circumstances, when all data sources are insufficient, the New York Fed may publish the prior day’s rates. In such instances, the change in data source will be noted when the rate is published.

In the event the rates are calculated using the federal funds and Eurodollar broker data, percentile summary statistics will not be published. Should the prior day’s rate be published, neither the percentile nor volume summary statistics will be published.

Data Exclusions for the EFFR and OBFR

In calculating the rates each day, the New York Fed will review the data to assess whether any errors are apparent in the dataset that could affect the accuracy of published statistics and, in some circumstances, may exercise expert judgment to determine whether reported transactions appear to be erroneous. Time permitting, the New York Fed will attempt to contact the relevant reporting institution in such situations to verify the accuracy of the reported data. Transactions that cannot be confirmed as correct or revised by the reporting institution prior to the rate publication may be excluded from the rate calculation. If an excluded transaction is subsequently confirmed or revised, the published rates will be subject to revisions as described in Rate Revisions.

Calculation Methodology for the EFFR and OBFR

Both the EFFR and the OBFR are calculated as a volume-weighted median, which is the rate associated with transactions at the 50th percentile of transaction volume. Specifically, the volume-weighted median rate is calculated by ordering the transactions from lowest to highest rate, taking the cumulative sum of volumes of these transactions, and identifying the rate associated with the trades at the 50th percentile of dollar volume.1 The published rates are the volume-weighted median transacted rate, rounded to the nearest basis point.

Also published alongside the volume-weighted median rate are the 1st, 25th, 75th and 99th volume-weighted percentiles and the transaction volume underlying the rate. The volume-weighted percentiles are calculated using the same volume-weighted methodology described above. Transaction volume is calculated as the sum of overnight transaction volume, rounded to the nearest billion. These additional summary statistics reflect the inputs included in the rate calculation, and will only be revised if amendments to the data result in a revision to the EFFR or the OBFR.

Note that the data source and calculation methodology of the EFFR changed beginning with the publication of the rate for March 1, 2016. March 1, 2016 also represented the first date for which the OBFR was published. For background on these technical changes, please see the following statements:

- Statement Regarding Planned Changes to the Calculation of the Federal Funds Effective Rate and the Publication of an Overnight Bank Funding Rate

- Statement Regarding the Calculation Methodology for the Effective Federal Funds Rate and Overnight Bank Funding Rate

- Statement Regarding the Implementation of Planned Changes to the Effective Federal Funds Rate and Publication of the Overnight Bank Funding Rate

Details on Publication and Revisions for the EFFR and OBFR

The EFFR and the OBFR will be published at approximately 9:00 a.m. ET each business day that is not included in the Federal Reserve Bank of New York's Holiday Schedule. In the event of a scheduled holiday, the EFFR and the OBFR, reflecting activity for the business day preceding the holiday, will be published on the subsequent business day. In the event that market participants recognize a previously unscheduled holiday, the New York Fed will publicly communicate its approach, with the goal of aligning as closely as possible to the approach used for scheduled holidays.

If transaction data were revised or an error were discovered in the calculation process subsequent to the rate publication on the same day, the affected rate or rates may be revised at approximately 2:30 p.m. ET. These revisions would only take place if the change in the published rate exceeds one basis point. Any time a rate were to be revised, a footnote would indicate the revision. This revision threshold will be reviewed periodically and may be amended based on market conditions.

If the EFFR were revised, the OBFR would also be revised, irrespective of whether the resultant change from recalculation were greater than the rate revision threshold. In this situation, the OBFR revision could result in a change to the volume or the percentiles. In other circumstances, the OBFR may be revised without a revision to the EFFR. Any revisions to the rates would be made on a same-day basis, except in extraordinary circumstances. The New York Fed may decide to revise the summary statistics or publish additional summary statistics on a lagged basis.

Updated summary statistics are published on a lagged basis shortly after the end of each quarter. These statistics may differ from the EFFR or the OBFR for a given day because the additional summary statistics may incorporate data that was not used in the calculation of the EFFR and the OBFR for that day pursuant to the "Rate Revisions," "Data Exclusions" or "Data Contingency" policies described above.

Additional summary statistics will be published as part of this lagged release. The most recent release can be found in the Additional Reference Rate Data section of this page.

Primary Data Inputs for the Treasury Repo Reference Rates

The New York Fed, in cooperation with the U.S. Department of the Treasury’s Office of Financial Research (OFR), publishes three Treasury repo reference rates based on transaction-level data collected under the supervisory authority of the Board of Governors of the Federal Reserve System and the authority of the OFR. Prior to January 24, 2022, transaction data were collected under the supervisory authority of the Board of Governors of the Federal Reserve System and from DTCC Solutions LLC, an affiliate of the Depository Trust & Clearing Corporation, under a commercial agreement.

The Tri-Party General Collateral Rate (TGCR) is a measure of rates on overnight, specific-counterparty tri-party general collateral repo transactions secured by Treasury securities, both centrally cleared and non-centrally cleared. Specific-counterparty transactions refer to those in which the counterparties involved know each other’s identity at the time of the trade. General collateral transactions are those for which the specific securities provided as collateral are not identified until after other terms of the trade are agreed. The rate excludes transactions to which the Federal Reserve is a counterparty. It is based on transaction-level tri-party data collected from the Bank of New York Mellon (BNY) and the OFR.

The Broad General Collateral Rate (BGCR) is a measure of rates on overnight Treasury general collateral repo transactions. The BGCR includes all trades used in the TGCR plus GCF Repo trades. It is based on the same transaction-level tri-party data collected from BNY and the OFR as well as GCF Repo data obtained from the OFR.

The Secured Overnight Financing Rate (SOFR) provides a broad measure of the general cost of financing Treasury securities overnight. The SOFR includes all trades used in the BGCR plus data on transactions cleared through the Fixed Income Clearing Corporation's Delivery-versus-Payment (DVP) repo service. In the DVP repo market, counterparties identify specific securities to settle each trade, rather than a population of acceptable collateral as in the tri-party repo market. As a result, the DVP repo market can be used to temporarily acquire specific securities. Repos for specific-issue collateral may be executed at rates below those for general collateral repos if cash providers are willing to accept a lesser return on their cash in order to obtain a particular security. In this case, the specific securities are said to be trading "special". In order to mitigate the influence of "specials" transactions on the measurement of the general cost of financing, 20 percent of the lowest-rate transaction volume from the DVP segment is removed each day. This 20 percent trim is applied after the exclusion of relevant affiliated trades. In order to ensure that 20 percent of the DVP volume is removed, a pro-rata calculation will be applied to the volume of each transaction occurring at the 20th volume-weighted percentile rate. This has the effect of removing some (but not all) transactions in which the specific securities are said to be trading "special".

Data Contingencies for the Treasury Repo Reference Rates

On most days, the New York Fed will calculate the Treasury repo reference rates based on tri-party repo, GCF Repo, and DVP repo data provided by BNY and the OFR from the prior business day. However, if data for a given market segment were unavailable, then the most recently available data for that segment would be utilized, with the rates on each transaction from that day adjusted to account for any change in the level of market rates in that segment over the intervening period. The published reference rates would be calculated from this adjusted prior day’s data for segments where current data were unavailable, and unadjusted data for any segments where data were available.

To determine the change in the level of market rates over the intervening period for the missing market segment, the New York Fed would use information collected through a daily survey conducted by its Trading Desk of primary dealers’ repo borrowing activity. Each day, the primary dealers report the volume of their borrowing activity in each of the various repo market segments included in the rates, as well as the volume-weighted average rate of this activity. To adjust the rates from the most recently available data for the missing segment, the overall change in the volume-weighted average rate across primary dealers would be added to or subtracted from each transaction, while leaving the volume of those transactions unchanged.

Below is an illustrative example of this methodology in practice:

Assume that a given market segment s consists of three transactions: $20 billion in transaction volume at 1 percent, $30 billion at 2 percent, and $40 billion at 3 percent on date (t-τ), the last day for which production data was available for segment s. Given a ten basis point change in the overall volume-weighted average rate of primary dealers’ repo borrowing in segment s from (t-τ) to t, the modified set of transactions for market segment s on date t would be equivalent to $20 billion in volume at 1.10 percent, $30 billion at 2.10 percent, and $40 billion at 3.10 percent. The rate on date t would be calculated based on this adjusted set of transactions as well as the available production data for the other market segments.

In other words, the New York Fed would follow the following steps:- for each market segment, s, is date t production data missing?

- if yes, then compute the volume-weighted mean rate from the Primary Dealer survey for segment s for dates t and (t-τ), which represents that last day with production data for the segment.2

- let δs,t-τ = change in volume-weighted mean survey rate for segment s from (t-τ) to t.

- for all transactions i in the missing segment s, set the adjusted rate Rs,i,t as: Rs,i,t= rs,i,t-τ+δs,t-τ , and, set the volume Vs,i,t=vs,i,t-τ.

- compute the published rate as the volume-weighted median across all transactions from the production data for the available segment(s) and the adjusted data for the missing segment(s).

Under extraordinary circumstances where the contingency data are unavailable, the New York Fed may publish the prior day’s rates. If data other than those provided by BNY or the OFR are used, the change in source will be noted when the rate is published.

For more information on how this procedure works in practice, please see the following:

Presentation about the New York Fed's first use of this data contingency on June 3, 2019

Note as well that in the event the rates are calculated using the primary dealer repo data detailed in the ‘Data Contingencies’ section, percentile summary statistics will not be published. Should the prior day’s rate be published, neither the percentile nor volume summary statistics will be published.

Data Exclusions for the Treasury Repo Reference Rates

In calculating the rates each day, the New York Fed will review the data to assess whether there are any transactions that should be excluded from the rate calculations for a given day, such as those that appear not to have been conducted at arm’s length, or that seem anomalous or potentially erroneous. The New York Fed may exercise expert judgment in making such determinations.

Calculation Methodology for the TGCR, BGCR, and SOFR

The TGCR, BGCR, and SOFR are each calculated as a volume-weighted median, which is the rate associated with transactions at the 50th percentile of transaction volume. Specifically, the volume-weighted median rate is calculated by ordering the transactions from lowest to highest rate, taking the cumulative sum of volumes of these transactions, and identifying the rate associated with the trades at the 50th percentile of dollar volume. At publication, the volume-weighted median is rounded to the nearest basis point.

Also published alongside the volume-weighted median rate are the 1st, 25th, 75th, and 99th volume-weighted percentile rates and the transaction volume underlying the rate. The volume-weighted percentiles are calculated using the same volume-weighted methodology described above. Transaction volume is calculated as the sum of overnight transaction volume used to calculate each reference rate, rounded to the nearest $1 billion. These additional summary statistics reflect the inputs included in the rate calculation and will only be revised on the day of initial publication if amendments to the data result in a same-day revision to any of the three rates.

For each rate, the New York Fed excludes trades between affiliated entities, when relevant and when the data to make such exclusions are available. Similarly, the New York Fed excludes trades negotiated for forward settlement. To the extent possible, “open” trades, for which pricing resets daily (making such transactions economically similar to overnight transactions), are included in the calculation of the rates. As noted above, 20 percent of the lowest-rate transaction volume from the DVP segment is removed each day.

For further information regarding the development of the three Treasury repo reference rates, please see the following:

- Request for Information Relating to Production of Rates (Notice and Request for Public Comment)

- Production of Rates Based on Data for Repurchase Agreements (Notice)

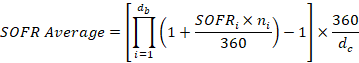

Calculation Methodology for the SOFR Averages and Index

In addition to the daily SOFR, the New York Fed also publishes three compounded averages of the SOFR with tenors of 30-, 90-, and 180-calendar days and a SOFR Index that allows for the calculation of compounded average rates over custom time periods. Note that, whereas the SOFR is published one business day following its value date (the day when overnight trades were negotiated), the SOFR averages and index are published on their value date. This approach aligns with the economics of the repo market, where the repo rate determines the cost of borrowing through the transaction’s maturity date. For the overnight repo transactions comprising the SOFR, the maturity date is always the next business day (when the SOFR is published), so the index and averages will always have a value date one business day later than the value date of the final SOFR observation included.

The SOFR Averages and Index employ daily compounding on each business day, as defined below in ‘Details on Publication and Revisions’. On any day that is not a business day, simple interest applies, at a rate of interest equal to the SOFR value for the preceding business day. In accordance with broader U.S. dollar money market convention, interest is calculated using the actual number of calendar days, but assuming a 360-day year.

The SOFR Averages for a given publication date incorporate all the SOFR values starting exactly 30-, 90-, and 180-calendar days before the publication date, regardless of whether or not that date is a weekend or holiday, and extend through the SOFR published that day.

Where:

- SOFRi = SOFR applicable on business day i

- ni = number of calendar days for which SOFR i applies (1 day for most Mondays-Thursdays, or 3 days for most Fridays, except in the case of holidays)

- dc = the number of calendar days in the calculation period (that is, 30-, 90-, or 180-calendar days)

- db = the number of business days in the calculation period

- i denotes a series of ordinal numbers representing each business day in the calculation period

In order to preserve the fixed-day-count structure, the SOFR Averages assign the SOFR value from the preceding business day when the start date of a given tenor falls on a weekend or a holiday. For example, if the start date falls on a Saturday, the SOFR for the preceding Friday would be applied for 2 calendar days (Saturday and Sunday). If the start date falls on a Sunday, the SOFR for the preceding Friday would be applied for 1 calendar day (Sunday).

An example of how holidays and weekends are treated in the SOFR Averages is summarized in the table below.

| SOFR Average Start Date |

SOFR ON Start Date |

First Compounding Term* |

| Wednesday | w | (1 + w × 2/360) |

| Thursday (Holiday) | N/A | (1 + w × 1/360) |

| Friday | y | (1 + y × 3/360) |

| Saturday | N/A | (1 + y × 2/360) |

| Sunday | N/A | (1 + y × 1/360) |

| Monday | z | (1 + z × 1/360) |

* Note: if, in the example above, Monday were a holiday and the start date of the average fell on the preceding Friday, then the first compounding term would be (1 + y × 4/360). |

||

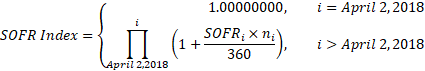

The SOFR Index measures the cumulative impact of compounding the SOFR on a unit of investment over time, with the initial value set to 1.00000000 on April 2, 2018, the first value date of the SOFR. The Index is compounded by the value of each SOFR thereafter. For example, the first official published SOFR Index value, on March 2, 2020, reflects the effect of compounding the SOFR each business day from April 2, 2018 through March 2, 2020.

An example of how this compounding approach is applied to the SOFR Index is summarized in the table below.

| Publication Date; SOFR Index Value Date |

SOFR Value Date |

SOFR | Calendar Days Applicable |

Index |

| Mon 4/2/2018 |

Thurs 3/29/2018 |

N/A* | N/A | 1.00000000 |

| Tue 4/3/2018 |

Mon 4/2/2018 |

1.80% | 1 | (1)(1 + 1.80% × 1/360) = 1.00005000 |

| Wed 4/4/2018 |

Tue 4/3/2018 |

1.83% | 1 | (1)(1 + 1.80% × 1/360) (1 + 1.83% × 1/360) = 1.00010084 |

| Thurs 4/5/2018 |

Wed 4/4/2018 |

1.74% | 1 | (1)(1 + 1.80% × 1/360) (1 + 1.83% × 1/360) (1 + 1.74% × 1/360) = 1.00014917 |

| Fri 4/6/2018 |

Thurs 4/5/2018 |

1.75% | 1 | (1)(1 + 1.80% × 1/360) (1 + 1.83% × 1/360) (1 + 1.74% × 1/360) (1 + 1.75% × 1/360) = 1.00019779 |

| Mon 4/9/2018 |

Fri 4/6/2018 |

1.75% | 3 | (1)(1 + 1.80% × 1/360) (1 + 1.83% × 1/360) (1 + 1.74% × 1/360) (1 + 1.75% × 1/360) (1 + 1.75% × 3/360) = 1.00034365 |

* Note: there was no SOFR for 3/29/2018. The first SOFR was published on 4/3/2018 for the value date of 4/2/2018; 3/30/2018 was recognized as a holiday by the SIFMA holiday calendar for U.S. government securities. |

||||

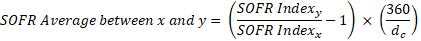

The following formula can be used to calculate compounded averages of the SOFR over custom time periods between any two dates within the SOFR publication calendar:

Where:

- x = start date of calculation period

- y = end date of calculation period

- dc = the number of calendar dates in the calculation period

Using this formula, the SOFR prints used in the custom SOFR Average will have value dates spanning the period between days x and y-1, the final overnight repo rate that covers the period maturing on date y.3

Given that the SOFR Index reflects the same arithmetic as the proposed SOFR Averages, rates calculated using the SOFR Index with the same start and end dates as the SOFR Averages should effectively produce equivalent results. However, because the SOFR Index is rounded, averages calculated from Index values do not maintain the same precision as the SOFR Averages; as a result, minor differences from the published averages may occasionally occur at the fifth decimal place.

For further information regarding the development of the SOFR Averages and Index, please see the following:

- Statement Requesting Public Comment on a Proposed Publication of SOFR Averages and a SOFR Index

- Statement Regarding Publication of SOFR Averages and a SOFR Index

Details on Publication and Revisions for the Treasury Repo Reference Rates

The TGCR, BGCR, SOFR, SOFR Averages, and SOFR Index, are typically published every business day, including days for which SIFMA recommends an early close for secondary market trading of U.S. government securities, but are not published on, or for, days for which SIFMA recommends a full closure. In addition, the New York Fed may, with advance notice, choose not to publish its Treasury repo reference rates on any given business day if participants in the Treasury repo market broadly expect to treat that day as a holiday.

The SOFR Averages and Index are published shortly after the SOFR is published at approximately 8:00 a.m. ET.

With regard to the publication of the TGCR, BGCR, and SOFR, if—subsequent to the rate publication on the same day—errors are discovered in the calculation process or the transaction data provided by either BNY or the OFR or if transaction data from BNY or the OFR had previously been unavailable in time for the morning publication but subsequently became available, the affected rate or rates and accompanying summary statistics may be revised at approximately 2:30 p.m. ET. Rate revisions will only occur if the change in the rate exceeds one basis point and only on the same day as initial publication. Any time a rate is revised, a footnote would indicate the revision. This revision threshold will be reviewed periodically and may be changed based on market conditions.

Similarly, the SOFR Averages and Index will only be revised on a same-day basis at approximately 2:30 p.m. ET, and only if either that day’s SOFR publication were also being revised or an error were discovered in the calculation of the SOFR Averages or Index.

For the TGCR, BGCR, and SOFR, updated summary statistics are published on a lagged basis shortly after the end of each quarter. These statistics may potentially differ from the originally published data if errors in the data provided by either BNY or the OFR or in the rate calculation process were discovered following the initial publication date, data from BNY or the OFR that had not been available on the initial publication date was subsequently received, or if same-day changes in the rates had not met the threshold for same day republication as described above.

Additional summary statistics will be published as part of this lagged release. The most recent release can be found in the Additional Reference Rate Data section of this page.

As detailed in the New York Fed's Statement of Compliance, the New York Fed has endeavored to adopt policies and procedures consistent with best practices for financial benchmarks. The New York Fed's Audit Group has concluded that the internal control structure over the production of the EFFR, OBFR, TGCR, BGCR and SOFR is effective and that the production of these rates is compliant with the applicable sections of the IOSCO Principles for Financial Benchmarks (the Principles). The New York Fed will assess the compliance of the reference rates with the Principles on an annual basis and issue a Statement of Compliance accordingly.

An internal Oversight Committee periodically reviews and provides challenge on the rate production process. The Committee consists of members from across the New York Fed organizational structure as well as members of the OFR, each of whom is not involved in the daily production of the reference rates. The New York Fed’s Chief Risk Officer and other senior staff from various control areas of the New York Fed review and provide challenge on each of the reference rates; the OFR provides review and challenge on the Treasury repo reference rates only. Among the Oversight Committee’s responsibilities are reviews of the rate production process, any use of non-standard procedures in the production of the rates, the robustness of the rate calculation methodologies, and policies regarding complaints received, audit findings, and conflicts of interest.

As a reference rate administrator, the New York Fed may seek to revise the composition or calculation methodology for one or more of the reference rates it administers in response to market evolution or for some other reason. An Oversight Committee, charged with periodically reviewing the composition and calculation methodology of each reference rate to ensure that it continues to properly reflect its underlying interest, will review and approve any such proposed changes. In its evaluation of proposed changes, the Oversight Committee will take into account relevant factors such as the uses of the affected reference rate(s) and the breadth and depth of those uses, the nature of the stakeholders, the resource implications of the proposed change(s), and any risks posed by potential delays in implementing the changes.

To the extent that changes being considered are deemed material4 by the Oversight Committee, the New York Fed will seek public comment in a manner that is proportional and appropriate to the circumstances. Typically, this will involve publishing a notice on its website detailing the proposed change, posing specific questions for feedback, and inviting interested parties to provide written comments by a specified date.

In most instances, the New York Fed will issue a final notice prior to implementing any material change(s) to its reference rates. This notification will describe the final change, explain the rationale for the change and what it entails, highlight any modifications to the proposed change that were made in response to public feedback, and note when the change will take effect. Additionally, the New York Fed anticipates that it will publish individual comments received during this public consultation as well as a summary response to those comments when it issues the final notice.

Depending on the nature of the change, however, alternative consultation mechanisms may be utilized, such as in instances where the Federal Reserve Board of Governors is required to engage in a formal notice-and-comment process for some types of changes.

The New York Fed has policies on ethics and conflicts of interest. In addition, staff will consider and address potential conflicts of interests and related concerns specific to administration of the rates.

Complaints about the rate calculation process or a given day’s rate should be submitted in writing to the New York Fed via the following email address: rateproduction@ny.frb.org. The New York Fed will investigate and review any such complaints and will endeavor to respond to the complainant in a timely manner. For additional resources to report complaints, please see Tips and Complaints.

- Quarterly FR2420 Summary Statistics (updated through Q3 2025)

- Quarterly Repo Summary Statistics (updated through Q3 2025)

- Daily brokered Fed Funds volumes and percentiles (Oct. 2006 - Feb. 2016)

- Daily indicative TGCR, BGCR, and SOFR volume and rate data (Aug. 2014 - Mar. 2018)

- Daily indicative SOFR averages and index (Apr. 2018 - Feb. 2020)

1 For example, assume that on a given day, $10 billion of federal funds transactions occurred at each of 5, 10, 15 and 20 basis points, and $60 billion occurred at 25 basis points. This represents $100 billion of total volume. The median would be the rate at the ‘middle dollar’, or $50 billion, which is 25 basis points in this example. Alternatively, if $20 billion of transactions occurred at 10, 15, 20 and 25 basis points, the volume-weighted median would be 15 basis points.

2 τ is the number of consecutive business days of missing production data for that segment. Thus, (t- τ) is the last day for which production data is available. Because this methodology is intended to be used for short-term contingency situations, we’d expect τ to equal 1. However, the methodology is able to accommodate scenarios where production data is missing for several days.

3 The SOFR Index can also be used to calculate compounded averages of the SOFR starting or ending on non-business days, however this requires additional calculations. This page previously provided instructions for approximating SOFR index values on non-business days. These instructions are appropriate for contracts that end on non-business days. However, they are under revision to provide proper guidance on approximating SOFR index values for contracts that begin on non-business days, which may require a different approach.

4 In general, a change will be deemed material if it would require updating the published methodology for the affected reference rate. Changes which do not require an update to the published methodology will generally be considered non-material and therefore would not require a public consultation.