Beginning on March 2, 2020, the Federal Reserve Bank of New York (New York Fed), as administrator of the Secured Overnight Financing Rate (SOFR) and in cooperation with the Treasury Department's Office of Financial Research (OFR), will publish 30-, 90-, and 180-day SOFR Averages as well as a SOFR Index, in order to support a successful transition away from U.S. dollar (USD) LIBOR. The new SOFR Averages will be referred to as “30-day Average SOFR”, “90-day Average SOFR” and “180-day Average SOFR.” The New York Fed released a consultation on November 4, 2019, requesting public comment on the proposed calculation and publication of the SOFR Averages and Index. Feedback received was broadly supportive of the initiative. The final parameters and a summary of the comments received are detailed below.

The SOFR Averages and Index will employ daily compounding on business days, as determined by the SOFR publication calendar.1 Simple interest will apply to any day that is not a business day, at a rate of interest equal to the SOFR value for the preceding business day.

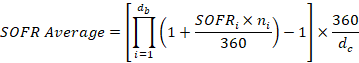

SOFR Averages:

Specifically, the SOFR Averages will be calculated as:

Where:

- SOFRi = SOFR applicable on business day i

- ni = number of calendar days for which SOFRi applies (often 1 day, or 3 days for typical weekend)

- dc = the number of calendar days in the calculation period (that is, 30-, 90-, or 180- calendar days)

- db = the number of business days in the calculation period

- i denotes a series of ordinal numbers representing each business day in the calculation period

The SOFR Averages for a given publication date will incorporate all the SOFR values starting exactly 30-, 90-, and 180-calendar days before the publication date, regardless of whether or not that date is a weekend or holiday, and extend through the SOFR published that day. In order to preserve the fixed-day count structure, the SOFR Averages will be assigned the SOFR value from the preceding business day when the start date of a given tenor falls on a weekend or a holiday. For example, if the start date falls on a Saturday, the SOFR for the preceding Friday would be applied for 2 calendar days (Saturday and Sunday). If the start date falls on a Sunday, the SOFR for the preceding Friday would be applied for 1 calendar day (Sunday).

| SOFR Average Start Date |

SOFR ON Start Date |

First Compounding Term* |

| Wednesday | w | (1 + w × 2/360) |

| Thursday (Holiday) | N/A | (1 + w × 1/360) |

| Friday | y | (1 + y × 3/360) |

| Saturday | N/A | (1 + y × 2/360) |

| Sunday | N/A | (1 + y × 1/360) |

| Monday | z | (1 + z × 1/360) |

* Note: if, in the example above, Monday were a holiday and the start date of the average fell on the preceding Friday, then the first compounding term would be (1 + y × 4/360). |

||

The SOFR Averages will be published as percentages rounded to the fifth decimal place.

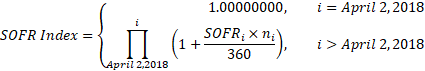

SOFR Index:

The SOFR Index will measure the cumulative impact of compounding the SOFR on a unit of investment over time, with the initial value set to 1.00000000 on April 2, 2018, the first value date of the SOFR. As a result, the first official published SOFR index value will reflect the effect of compounding the SOFR each business day since April 2, 2018 through March 2, 2020. Specifically, the SOFR Index will be calculated as:

Where:

- SOFRi = SOFR applicable on business day i

- ni = number of calendar days for which SOFRi applies

- i represents a series of ordinal numbers representing each business day in the calculation period

The SOFR Index will be published as a number rounded to the eighth decimal place. An example of how this compounding approach is applied to the index is summarized in the table below.

| Publication Date |

SOFR Value Date |

SOFR | Calendar Days Applicable |

Index |

| Mon 4/2/2018 |

Thurs 3/29/2018 |

N/A* | N/A | 1.00000000 |

| Tue 4/3/2018 |

Mon 4/2/2018 |

1.80% | 1 | (1)(1 + 1.80% × 1/360) = 1.00005000 |

| Wed 4/4/2018 |

Tue 4/3/2018 |

1.83% | 1 | (1)(1 + 1.80% × 1/360) (1 + 1.83% × 1/360) = 1.00010084 |

| Thurs 4/5/2018 |

Wed 4/4/2018 |

1.74% | 1 | (1)(1 + 1.80% × 1/360) (1 + 1.83% × 1/360) (1 + 1.74% × 1/360) = 1.00014917 |

| Fri 4/6/2018 |

Thurs 4/5/2018 |

1.75% | 1 | (1)(1 + 1.80% × 1/360) (1 + 1.83% × 1/360) (1 + 1.74% × 1/360) (1 + 1.75% × 1/360) = 1.00019779 |

| Mon 4/9/2018 |

Fri 4/6/2018 |

1.75% | 3 | (1)(1 + 1.80% × 1/360) (1 + 1.83% × 1/360) (1 + 1.74% × 1/360) (1 + 1.75% × 1/360) (1 + 1.75% × 3/360) = 1.00034365 |

* Note: there was no SOFR for 3/29/2018. The first SOFR was published on 4/3/2018 for the value date of 4/2/2018; 3/30/2018 was a holiday according to the SIFMA calendar for U.S. government securities. |

||||

The SOFR Averages and Index will be published on each day that the SOFR is published, to a dedicated web page on the New York Fed’s website, shortly after the SOFR is published at approximately 8:00 a.m. ET. The SOFR Averages and Index will only be revised on a same-day basis (at approximately 2:30 p.m. ET) and only if either that day’s SOFR publication was also revised or if an error was discovered in the calculation of the Averages or Index.

Respondents to the request for public comment broadly supported the effort to provide a benchmark that could be referenced in a variety of products, such as consumer loans and floating rate notes (FRNs). The large majority agreed with the proposed compounding methodology and publication arrangements of the SOFR Averages and Index.

Significant feedback was received suggesting that, rather than fixed 30-, 90-, and 180-calendar-day tenors, the SOFR Averages should use calendar month-based tenors and/or have start dates determined by the “modified following” convention commonly used in derivatives contracts.2 However, the modified following convention is typically applied in a forward-looking context, whereas the SOFR Averages are backward-looking. In attempting to replicate the calendar months determined in a forward-looking context, there are various methodologies that could be used and determining the optimal approach for the public would require additional investigation.

Another common suggestion was to publish an additional SOFR Average with a 360-day, or 1-year, tenor.

Given the broad support for the publication of the SOFR Averages, and in the interest of introducing a set of averages that can be referenced by the public promptly, the New York Fed judges it prudent to begin publishing the 30-, 90-, and 180-day SOFR Averages on March 2. After these tenors are launched, the potential benefit of introducing calendar month-based rates and/or adding one or more additional tenor(s) as additional reference rates will be considered. We note that the SOFR Index will allow for the derivation of calendar month-based rates—or any custom period such as 360-day or 1-year tenors—using any two business dates.

Shortly after the March 2 initial launch, the New York Fed plans to publish an update to the indicative series of data of the SOFR Averages and Index from April 2, 2018 through March 2, 2020.

Public Comments on the Proposed Calculation and Publication of the SOFR Averages and Index

1 The SOFR is published each business day that is not broadly recognized as a holiday by the SIFMA calendar for U.S. government securities.

2 “Modified following” is a type of business day convention in which payment days that fall on a weekend or holiday roll forward to the next business day; if the next business day falls in the next calendar month, the payment day rolls back to the preceding business day.