Thank you for participating in the conference "Monetary Policy Implementation in the Long Run" here at the Federal Reserve Bank of Minneapolis. Over the past two days we have engaged in productive and thought-provoking discussions of the evolution of monetary policy implementation across global central banks. These discussions will help shape the way the Federal Reserve thinks about monetary policy implementation in the future.

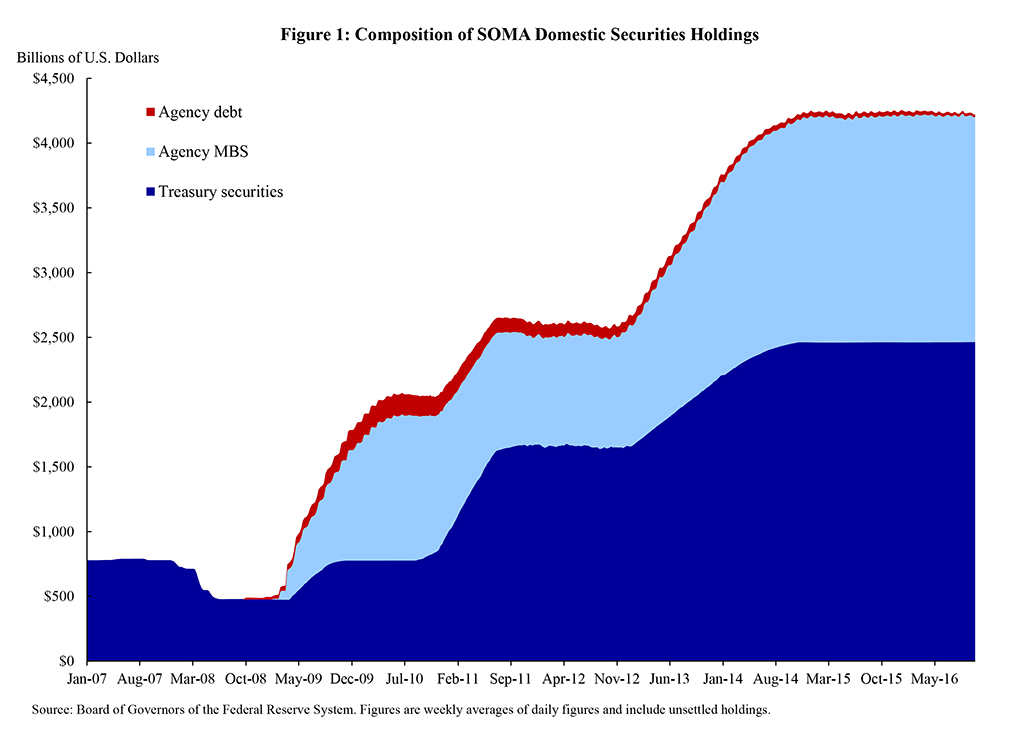

The Federal Reserve's implementation of policy has evolved in important ways in recent years, including using the balance sheet as an active policy tool at the zero lower bound (ZLB). Through a series of large-scale asset purchase programs (LSAPs), the Federal Reserve's balance sheet expanded to include more longer-term Treasury securities and two additional asset classes, agency debt and agency mortgage-backed securities (MBS).2 Agency MBS currently represent more than 40 percent of the System Open Market Account (SOMA) domestic portfolio.3 (Figure 1) Furthermore, in order to maintain the size of the SOMA's agency holdings, the New York Fed's Open Market Trading Desk (the Desk) continues to reinvest principal paydowns on agency MBS and agency debt into agency MBS each month.4 In my remarks today, I will share some reflections on LSAPs at the ZLB and the flexibility that access to the agency MBS market gives the Federal Reserve to execute such programs. Before I begin, however, let me remind you that the views I express are my own and do not necessarily reflect those of the Federal Reserve Bank of New York or the Federal Reserve System.

Large-Scale Asset Purchase Programs

Currently, all the major advanced-economy central banks are either at or close to the zero lower bound. Their approach to adding policy accommodation with a near-zero overnight policy rate has been to use outright purchases of assets, term lending schemes, and forward guidance on these policy tools.5 The policy of outright purchases of assets is often called quantitative easing (QE) because of the Bank of Japan's earlier policy focused solely on increasing the size of the central bank's liabilities.6 While QE is a useful catch-all term for this set of policies, it masks the fact that central banks make different choices in the assets they buy to expand their balance sheets.7 Central bank laws specifying which assets can be purchased and held outright vary, although nearly all central banks can buy and hold the debt issued by their sovereign.8 Indeed, most of the empirical work on the effectiveness of LSAPs is based on the analysis of sovereign debt purchases. More recently, a number of central banks have extended their purchases into the corporate debt and asset-backed securities markets. The Federal Reserve Act does not permit the purchase of privately issued debt such as corporate debt or privately issued ABS. While this might appear to be a constraint for the Federal Reserve, purchases of non-sovereign debt by other central banks have been small—both in size and as a percentage of GDP—compared with the Federal Reserve's purchases of agency MBS, which are guaranteed by federal agencies and can affect private borrowing rates.9

In expanding their balance sheets through asset purchases, central banks must consider how their choice of assets—for example, sovereign debt, corporate bonds, or federal agency debt—will affect the policy transmission mechanism. Central banks must also take into account any implementation challenges related to executing in a given market. There are many broad transmission channels through which an LSAP program can provide additional monetary accommodation:

- Increasing the monetary base and central bank liabilities—the QE channel

- Reinforcing that interest rates will remain low—the signaling channel10

- Changing the quantity and mix of financial assets held by the private sector—the portfolio balance channel

- Taking interest rate risk out of the private sector—the duration channel

- Taking credit risk out of the private sector—the credit channel

- Taking prepayment risk out of the private sector—the prepayment channel

- Improving market function—the market function channel

The purchases of different assets will have different degrees of impact across these channels. For example, sovereign assets will generally work primarily through the first four channels, while corporate bonds would also work through the credit channel and MBS would also work through the prepayment channel. For these first six channels, one can argue that it is the expected stock of security holdings to be purchased by a central bank that chiefly determines the amount of accommodation—that is, the impact the central bank's purchases are expected to have on the size and duration of assets available to the public. Alternatively, for the market function channel, the "flow" effects are most important, in that the transactions associated with a central bank's asset purchases can also affect an asset price by altering market liquidity and functioning, although such effects may dissipate quickly. This channel could achieve monetary accommodation through the purchase of any security type in which market functioning has become stressed. One example is the European Central Bank's Securities Markets Programme, which was designed "to address the malfunctioning of securities markets".11

The purchase of non-sovereign assets can be helpful by providing additional channels for monetary accommodation to be realized. Further, having additional markets to operate in can help central banks overcome functional limitations that could exist if they were restricted to LSAPs in only one market. For example, the stock of assets held by the private sector in a given market might be too small to meet the monetary policy goal. Or, the purchase of a large amount of the existing stock of a given market might result in impaired market functioning, which, in the extreme, could impair the effectiveness of the LSAP and other monetary policy tools. Lastly, when participating in non-sovereign markets for the first time, a central bank might need to learn more about the asset class and build or refine the internal systems needed to operate in that market.12 In all these cases, a central bank might choose to diversify across different asset classes to achieve its policy objective.

With these considerations in mind, I now want to turn to a discussion of the large-scale asset purchase programs pursued by the Federal Reserve. My focus will be on the Fed's agency MBS purchases—which provide the central bank with an additional policy transmission tool and significant additional capacity to provide policy accommodation. Although the purchase of U.S. Treasuries is not central to my remarks, it is important to note that the Federal Reserve is fortunate in having a sovereign debt market that is the deepest and most liquid in the world and is sufficiently large that there are no close capacity limits. The experience with the three LSAP programs and the Maturity Extension Program showed that the Federal Reserve was able to purchase Treasuries at a fast pace without affecting market functioning.

Before continuing to the main part of my discussion, I would also note that my intention is to consider the practical and operational issues surrounding the implementation of LSAPs, rather than to debate the merits of LSAPs relative to other potential monetary policy tools. There are a number of important issues linked to the potential costs of LSAPs but unrelated to these implementation issues. Policymakers' judgments on these costs, such as financial stability impacts, political economy ramifications, and the effect on the consolidated fiscal situation, will be critical in assessing the overall costs and benefits of LSAPs.13 These caveats are particularly important to bear in mind in looking at the agency MBS market, since many might argue that the main issuers in the agency market gained private benefits at the expense of the taxpayers in the period prior to the financial crisis.14

Overview of the U.S. Agency Mortgage Market

In depth and liquidity, the agency MBS market is second only to the U.S. Treasury market domestically; it is also deeper than most foreign sovereign debt markets. The fixed-rate agency MBS market currently has roughly $5.7 trillion outstanding, with an estimated average daily trading volume of approximately $200 billion in 2016 year-to-date.15 In contrast, the slightly larger U.S. corporate market has an average daily trading volume of only $30 billion per day.16

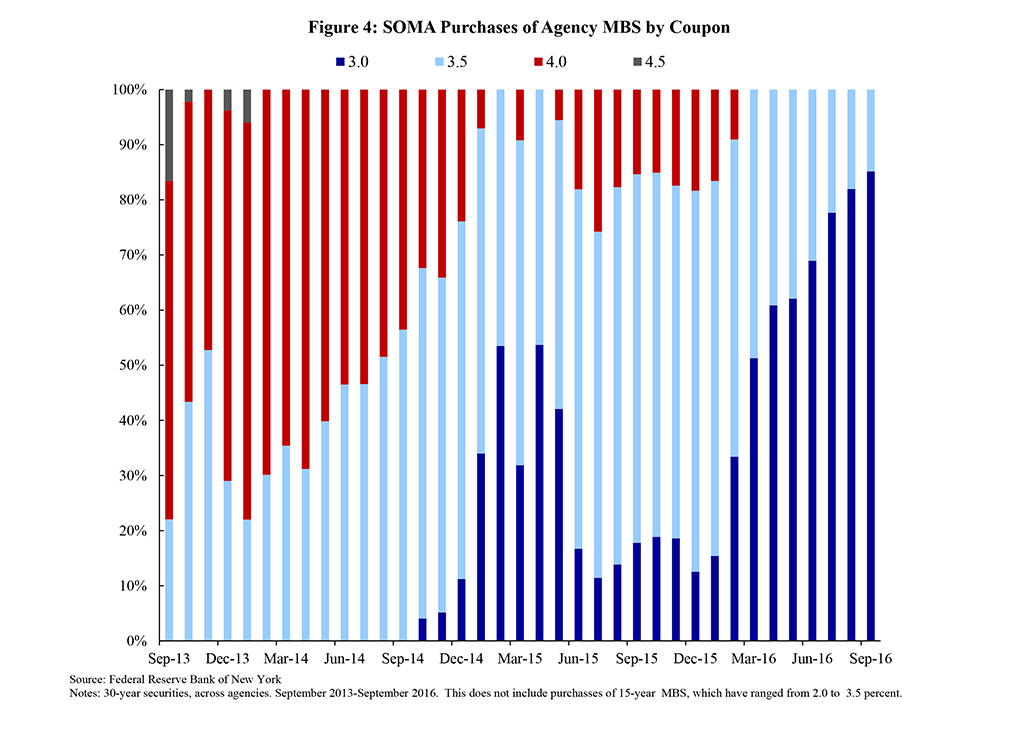

The substantial trading volume and liquidity of the agency MBS market are due, in large part, to the existence of the to-be-announced (TBA) MBS trading convention. This structure provides investors with the ability to trade a wide range of MBS with similar characteristics without requiring them to analyze the underlying details of each individual mortgage security, since any security with the same agency issuer, original maturity term, and coupon can be delivered into a single TBA contract. 17 This transforms a market of hundreds of thousands of individual mortgage securities into a limited number of homogenous TBA contracts. For example, in July 2016, the Desk purchased approximately $34.5 billion in agency MBS across only 10 different TBA contracts; upon settlement of those transactions the following month, SOMA received almost 2,000 different individual MBS securities. In addition, the TBA market trading convention allows for the use of dollar rolls (which extend the settlement date by one month) and coupon swaps (which allow the specific TBA contract being purchased to be switched). These trading tools have been used to facilitate efficient settlement and can alleviate market stress.18

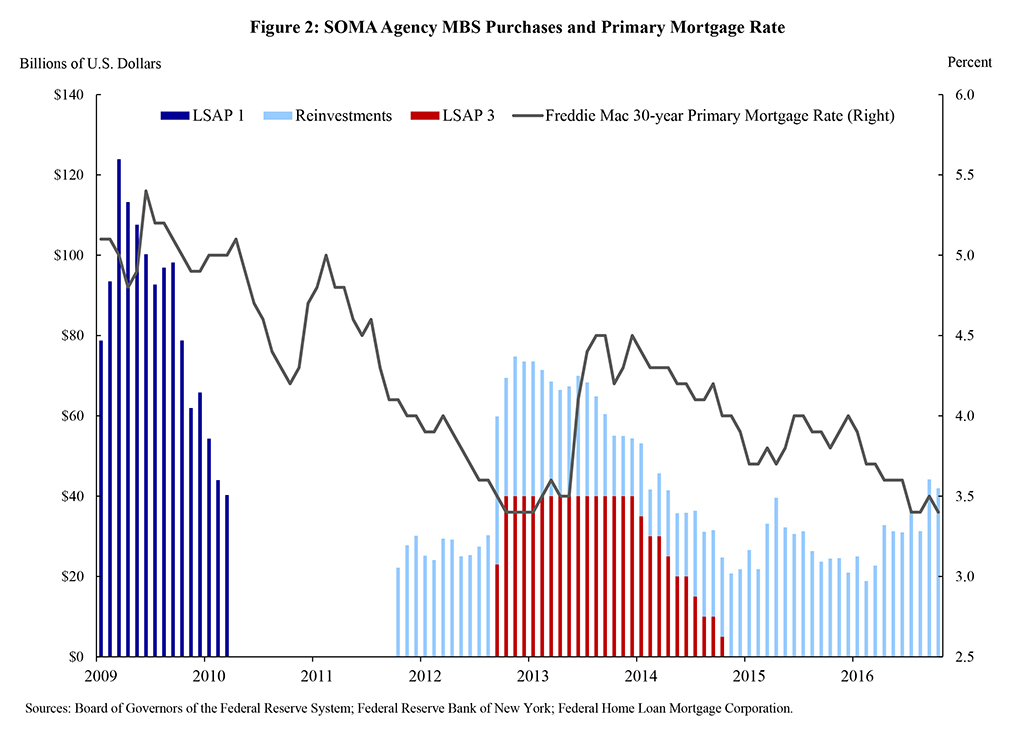

The liquidity and market depth provided by the TBA trading convention facilitate the Desk's ability to conduct large-scale asset purchases in a non-sovereign market and to do so at a relatively fast pace without hindering market functioning. For example, the Desk purchased more than $1 trillion agency MBS in 2009 and almost $800 billion of agency MBS in 2013. These purchases allowed the SOMA portfolio, which owned no agency MBS at the end of 2008, to expand its agency MBS holdings to approximately $1.76 trillion by October 2014.19 (Figure 2)

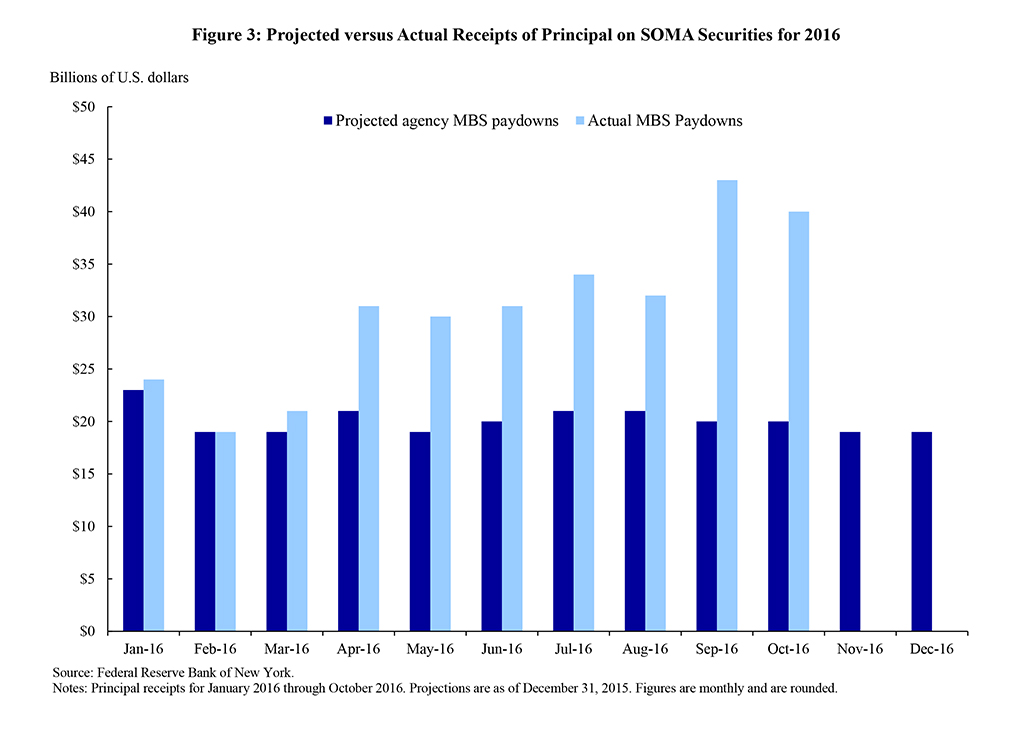

SOMA agency MBS holdings have been maintained near this level since the end of the latest purchase program on October 29, 2014. These holdings constitute approximately 10 percent of GDP and account for almost one-third of the universe of fixed-rate agency MBS. The SOMA portfolio of agency MBS is considerably larger than the portfolios of non-sovereign debt that other global central banks have purchased, which represent about 5 percent of GDP and less than 10 percent of each individual market.20 Similarly, purchases can be conducted at a pace that provides a meaningful level of accommodation without any adverse effects on market functioning. 21 Over the past month, the Desk reinvested approximately $44 billion of principal payments from its holdings of agency MBS and agency debt in the TBA market.22 (Figure 3) By comparison, purchases of non-sovereign debt at the ECB, BoE, and BoJ have all been at a pace of less than $15 billion per month.23

The payment structure of agency MBS is unique since the principal and interest of agency MBS are guaranteed by one of three federal agencies: Fannie Mae, Freddie Mac, and Ginnie Mae. However, the cash flows behind these securities are based upon the mortgage payments of millions of homeowners whose home mortgages have been securitized in an agency MBS. This structure allows the Federal Reserve to support private borrowing, and the housing market, while purchasing federal agency securities. This feature is important for policymakers to consider when deciding whether to operate in the agency MBS market or the Treasury market.

Agency MBS, like the underlying mortgages, have monthly payments of principal and interest. Homeowners also have the option to make additional principal payments each month, or to pay off the loan in full. Prepayment is especially attractive when interest rates fall and homeowners are able to refinance their loans into new loans at a lower interest rate. Investors demand an extra return to bear the risk of prepayment, which is incorporated into the yield of agency MBS. By purchasing agency MBS, the Federal Reserve can bear a considerable amount of this risk, removing it from the portfolios of private investors and thereby lowering mortgage rates. This outcome, in turn, stimulates additional demand for housing, and promotes increased refinancing activity. In the current environment, the Federal Open Market Committee (FOMC) has directed that principal payments from SOMA's agency debt and agency MBS portfolio be reinvested into agency MBS. Therefore, SOMA reinvests the monthly paydown of principal on an ongoing basis. As a result, the Federal Reserve maintains a regular presence in the agency MBS market with near daily purchase operations. (Figure 4)

Review of the Federal Reserve's Two Agency MBS Purchase Programs

Since 2008, two LSAP programs have included the purchase of agency MBS. The primary goals of the two programs differed, reflecting the distinct market conditions and economic environment that existed at the time each was initiated. In LSAP 1, announced in November 2008, agency MBS purchases were chiefly designed to provide support to mortgage and housing markets and to foster improved conditions in financial markets more generally. In LSAP 3, launched in September 2012, the agency MBS purchases were primarily focused on providing overall policy accommodation.

In November 2008, there were significant dislocations in many financial markets, especially in the markets for the U.S. federal housing agencies' securities.24 In addition, the housing market was a focal point of the financial crisis. To help support the housing market and improve conditions in financial markets, the FOMC announced an LSAP program on November 25, 2008, that consisted of purchases of agency debt and agency MBS.25 The stated purpose of this program was to "reduce the cost and increase the availability of credit for the purchase of houses, which in turn should support housing markets and foster improved conditions in financial markets more generally."26 Research suggests that this program reduced "abnormal pricing" in agency MBS—the component of the spread considered to be due to market dysfunction—by about 70 basis points over its first six months. 27 In that same time period, the spread of agency MBS repurchase agreements (repos) to Treasury repos fell from more than 200 basis points to near zero. In the framework noted above, this LSAP worked primarily through the market functioning channel. However, research also suggests that borrowing costs were lowered more broadly through a portfolio balance effect.28 Overall, the Desk's purchases, aided by the lowering of fed funds to the ZLB in December 2008, resulted in lower mortgages rates, which in turn reduced the cost of home purchases and allowed existing borrowers to refinance at more attractive terms.

Following the initial LSAP, the liquidity and market functioning of the housing agency securities largely normalized; however, the pace of economic growth remained modest. Therefore, in September 2012, the FOMC started an outcome-based program to purchase $40 billion of agency MBS per month.29 Agency MBS purchases were added to the ongoing Treasury-related programs as a means of putting additional downward pressure on longer-term interest rates to make broader financial conditions more accommodative and to provide further support to mortgage markets. Consistent with this objective, research suggests that the impact of MBS purchases in LSAP 3 worked primarily through the reduction of general interest rates, with both agency MBS and Treasury security purchases having a similar effect on agency MBS yields.30 While MBS purchases also lower MBS yields through the prepayment channel, a further benefit of agency MBS purchases during LSAP3 may have been in facilitating a faster pace of total long-term debt purchases which increases the impact of the duration and portfolio balance channels by increasing the expected stock of the central bank's total longer-term debt holdings. In contrast to LSAP1, LSAP3 was not found to operate through the market function channel.

Summary and the Potential Role of Agency MBS in the Future

Overall, the size and structure of the agency MBS market make it a desirable choice for conducting operations of the magnitude necessary to have a meaningful impact on financial and macroeconomic conditions in the United States. Our experience with agency MBS purchases suggests that they have been successful across both dimensions. In contrast, the Federal Reserve's experience conducting sales of agency MBS is limited to a few small value exercises. 31 Central banks that are currently buying non-sovereign assets in LSAPs have a similar lack of experience with sales. There may be separate lessons to be learned from selling agency MBS.32

Current FOMC guidance states that the sale of agency MBS is not anticipated, other than potentially to eliminate residual holdings well in the future, and that in the longer run, SOMA will consist primarily of Treasury securities.33 From a practical standpoint, sales may be complicated in that they would likely be conducted through the sale of individual securities, not through the use of the TBA market, because the securities in the SOMA portfolio might be more valuable than TBA cheapest-to-deliver.34 This complication could eliminate the liquidity advantage provided by transacting in TBA.35 However, it is prudent for the Desk to be prepared for a wide variety of scenarios, including sales or the need to purchase additional agency MBS. This flexibility is particularly important given the complex nature of agency MBS and the specialized knowledge and systems required to hold and transact in the agency MBS market.

From an implementation perspective, the Federal Reserve is fortunate to have the option of implementing monetary policy in a large and liquid non-sovereign market with direct implications for existing and prospective homeowners. We have spent the past two days discussing monetary policy implementation in the long run. Given the Federal Reserve's experience in the agency MBS market over the past eight years, it is important to consider what role—if any—agency MBS transactions may have in the policy implementation toolkit of the future.