Data and Indicators

The Research and Statistics Group provides the following links to online sources of economic data produced by the New York Fed and other Reserve Banks.

Key Data from the New York Fed

The CMDI is a summary metric of corporate bond market functioning based on information from multiple sources including measures of primary market issuance and pricing, secondary market pricing and liquidity conditions, and the relative pricing between traded and nontraded bonds. It updates monthly.

A monthly survey of service firms in New York State, northern New Jersey and southwestern Connecticut, conducted by the New York Fed.

Summary of responses to topical questions from the Empire State Manufacturing Survey and the Business Leaders Survey.

This web feature tracks employment in state and metro regions in the Federal Reserve’s Second District, utilizing the New York Fed’s early benchmarks of payroll employment data. It updates monthly.

Monthly releases of early benchmarked employment figures for New York State, New Jersey, Puerto Rico, and the U.S. Virgin Islands, as well as the metropolitan areas in New York and Northern New Jersey.

The mission of the Applied Macroeconomics and Econometrics Center (AMEC) is to provide intellectual leadership in the central banking community in the fields of macro and applied econometrics.

Data Releases

Global Supply Chain Pressure Index

(Updated: Monthly)

Measuring the Natural Rate of Interest

(Updated: Quarterly)

Multivariate Core Trend Inflation

(Updated: Monthly)

The New York Fed DSGE Model

(Updated: Quarterly)

Data Releases

Global Supply Chain Pressure Index

(Updated: Monthly)

Measuring the Natural Rate of Interest

(Updated: Quarterly)

Multivariate Core Trend Inflation

(Updated: Monthly)

The New York Fed DSGE Model

(Updated: Quarterly)

New York Fed Staff Nowcast

(Updated: Weekly)

(Updated: Weekly)

Outlook-at-Risk

(Updated: Monthly)

Treasury Term Premia

(Updated: Daily)

Yield Curve as a Leading Indicator

(Updated: Monthly)

(Updated: Monthly)

Treasury Term Premia

(Updated: Daily)

Yield Curve as a Leading Indicator

(Updated: Monthly)

The Center for Microeconomic Data offers wide-ranging data and analysis on the finances and economic expectations of U.S. households.

Analysis of trends in U.S. consumers' borrowing and indebtedness, based on the New York Fed Consumer Credit Panel, a unique longitudinal data set. Reports are available from 2010 through the present.

A monthly survey of consumer expectations regarding inflation, future earnings, household income, house prices, access to credit, layoff risk, and U.S. economic conditions overall.

Quarterly report tracking the consolidated financial condition of the U.S. commercial banking industry, including aggregate trends in profitability, assets, capital, and other key variables.

Dynamic Data and Maps from the New York Fed

This interactive web feature presents a wide range of job market metrics for recent college graduates, including trends in unemployment rates, underemployment rates, and wages. Data are updated regularly and available for download.

Interactive maps and charts shed light on the unprecedented growth, market share, student loans, tuition pricing, federal grants, and more for for-profit higher education institutions.

A series of interactive maps tracks school funding and expenditures in New York and New Jersey, revealing a wide variability in finances across districts and over time.

Interactive graphics tracking student loan borrowing and delinquency rates by age group and over time.

Maps showing percentage changes in home prices from a year earlier for nearly 1,200 counties using CoreLogic data. With video sequence of these changes since 2003.

Charts, depicting the interplay between the unemployment rate, the labor force participation rate, and the employment-to-population ratio over five recent recessions. Data are available by gender and age group.

Tools and Indicators from the New York Fed

A calendar showing the date and time of key economic data releases. Links to data sources are provided when available.

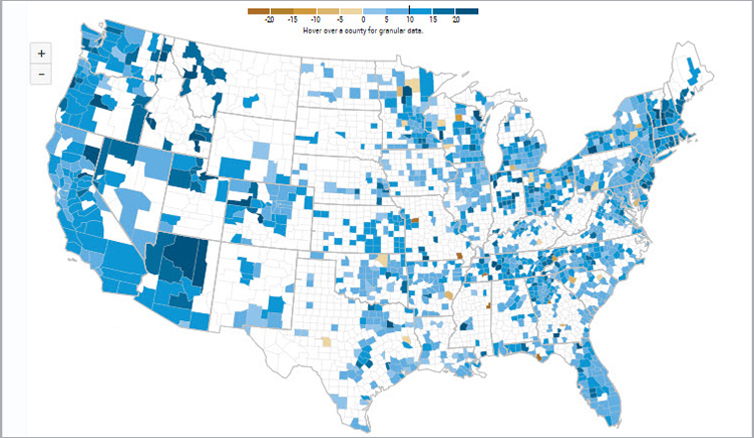

Losses from Natural Disasters provides county-level estimates of the economic and human impact of extreme weather events in the United States.

RDE estimates provide a quantitative measure of the ampleness of reserves in the U.S. banking system in real time. New data are published monthly.

The EHIs are broad-based economic indicators that measure macroeconomic outcomes experienced by different demographic, economic, and geographic groups on both a regional and national level.

Current economic data covering the Second District and local areas in New York State, New Jersey, Connecticut, Puerto Rico, and the U.S. Virgin Islands.

The Blackbook, which represents our main pre-FOMC briefing document to the Bank president, includes the Research staff’s policy recommendation for the coming FOMC meeting.

A New York Fed data set documenting historical linkages between regulatory entity codes and Center for Research in Security Prices (CRSP) PERMCOs for publicly traded banks and bank holding companies. Useful for researchers needing to match market data and regulatory data.

From Other Reserve Banks

A database developed by the St. Louis Fed that consists of more than 213,000 U.S. and international economic time series. Users can download and interact with the data.

A data set developed by the Philadelphia Fed that consists of vintages, or snapshots, of time series of major macroeconomic variables.

By continuing to use our site, you agree to our Terms of Use and Privacy Statement. You can learn more about how we use cookies by reviewing our Privacy Statement.

Losses from Natural Disasters

Losses from Natural Disasters Reserve Demand Elasticity (RDE)

Reserve Demand Elasticity (RDE) Economic Heterogeneity Indicators (EHIs)

Economic Heterogeneity Indicators (EHIs)